Bafin Solvency Ii

According to Aba, BaFin has used the Solvency II regulation to design the requirements also for the business organization of occupational pension schemes The rules to calculate technical reserves, it added, are inspired by Solvency II and are not in line with the IORP II directive.

Bafin solvency ii. Germany BaFin publishes General Administrative Act Solvency II insurance undertakings will no longer be authorised to operate EUwide, as provided for in Article 15(1) of Directive 09/138/EC This also applies to IORPs whose crossborder activities are governed by Articles 11 and 12 of Directive (EU) 16/2341. Dr Steffen is likely to provide a good behind Solvency II is to increase and Occupational Pensions Supervisors (CEIOPS), the key adviser to the European measures for Solvency II Under his direction, BaFin is about to introduce a new set of Supervisory Minimum Requirements for Risk Management by Insurance Undertakings. BaFin extends Solvency II reporting exemptions until further notice Smaller insurers to benefit from BaFin decree Re/insurers should meet Solvency II reporting deadlines, says Eiopa Authority previously recommended flexibilities in reporting due to Covid19.

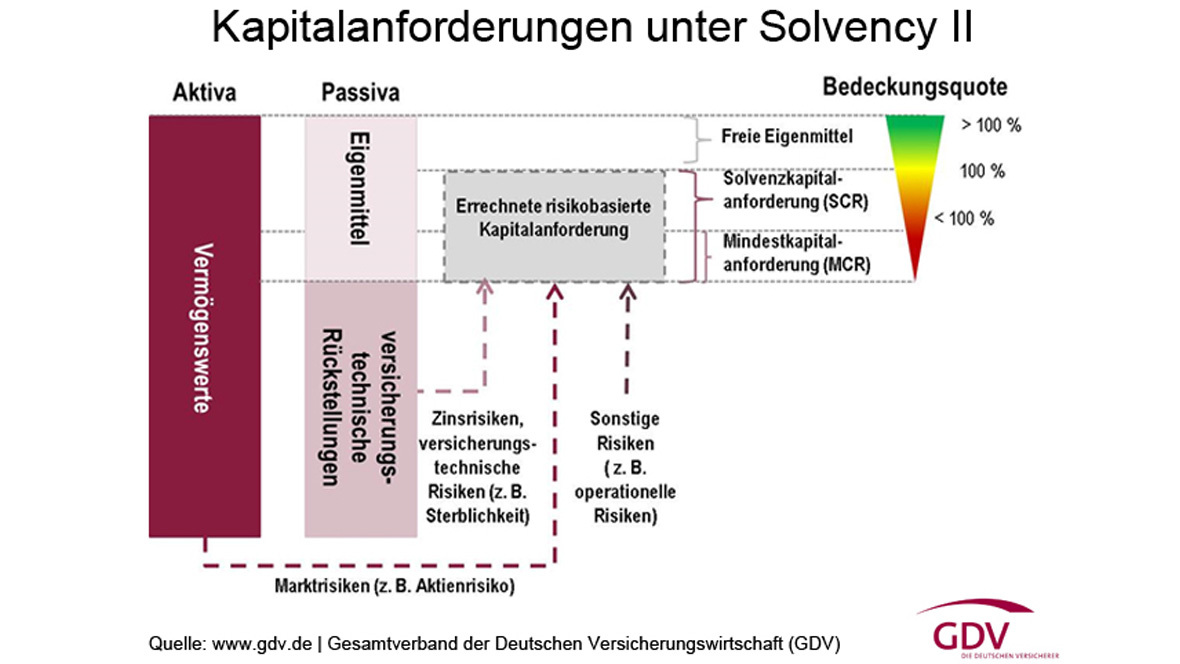

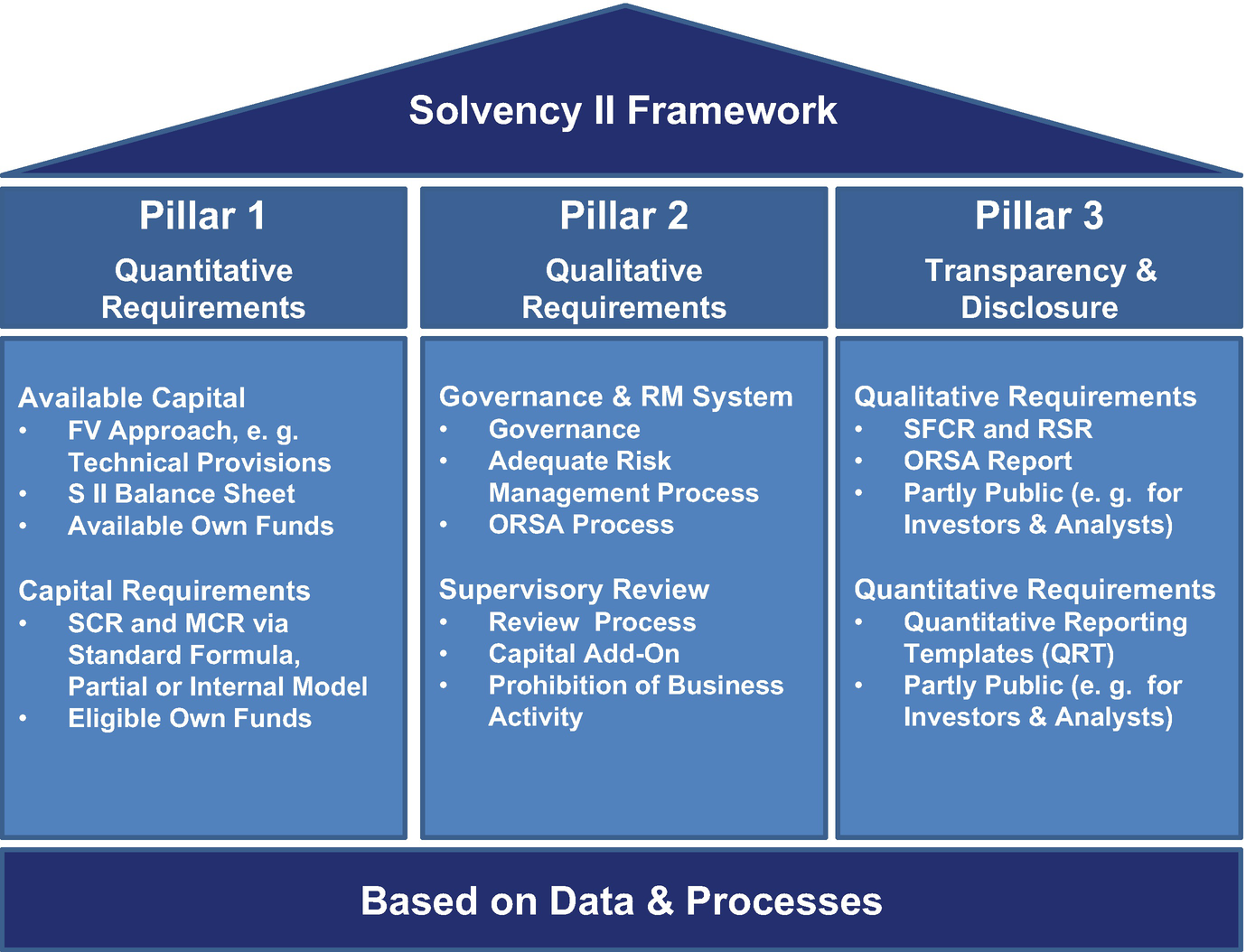

BaFin’s expectations With the amendment of the Insurance Supervisory Act (9th amendment in 07) and the publication of the MaRisk VA in January 09, Germany is already anticipating the implementation of the qualitative Pillar 2 requirements of the future Solvency II regime The main consequences of the MaRisk VA are, firstly the. Main Takeaways The European Commission (EC)’s Delegated Regulation of 19 amends the Solvency II Directive in different areas Most notably, from an investment perspective, a new category of equity investments has been introduced to the equity risk submodule Longterm Equity (LTE) investments. With the introduction of Solvency II on 1 January 16, the direct regulation of investments held in the restricted assets has been replaced for primary and reinsurance undertakings by riskbased solvency capital requirements (market risk module, counterparty default risk).

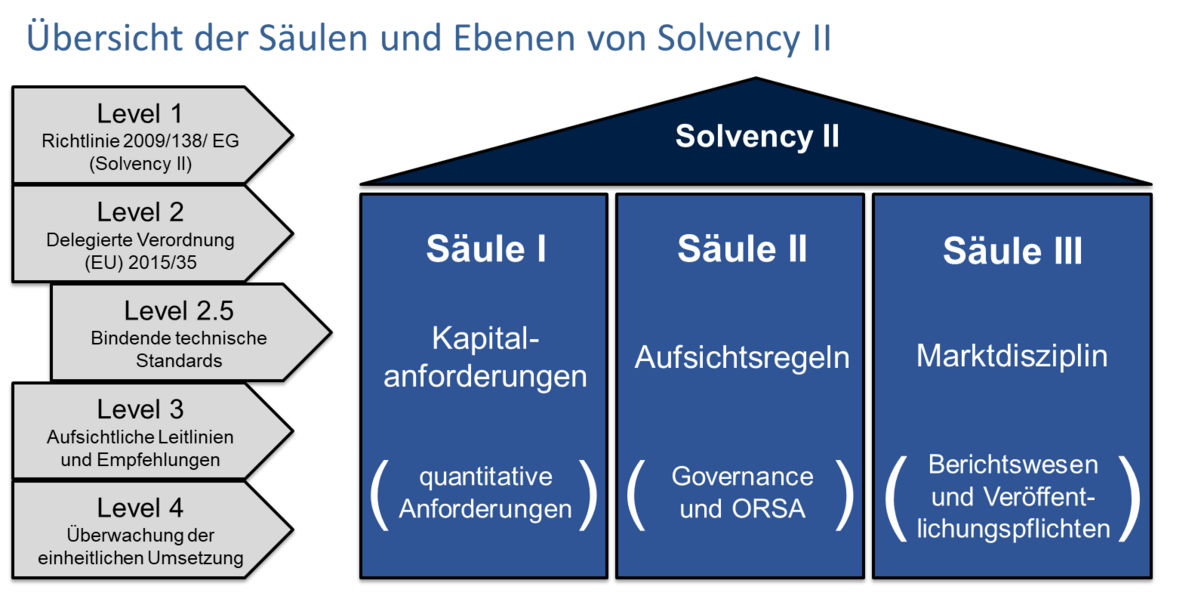

In der zweiten Säule von Solvency II werden einerseits die Grundsätze und Methoden der Aufsicht und andererseits die qualitativen Anforderungen an die Ausübung der Tätigkeit der Versicherer festgelegt. Solvency capital requirements are part of the Solvency II Directive issued by the EU in 09, which is one of more than a dozen existing EU directives The directive aims to coordinate the laws. Insurers in 21 European countries using BearingPoint’s proven ABACUS/Solvency II platform submitted the “Day 1” reports and the first quarterly reports at the end of May to local supervisors in various European countries, such as the Central Bank of Ireland, PRA in the UK, BaFin in Germany, CAA in Luxembourg, FI in Sweden, IVASS in Italy.

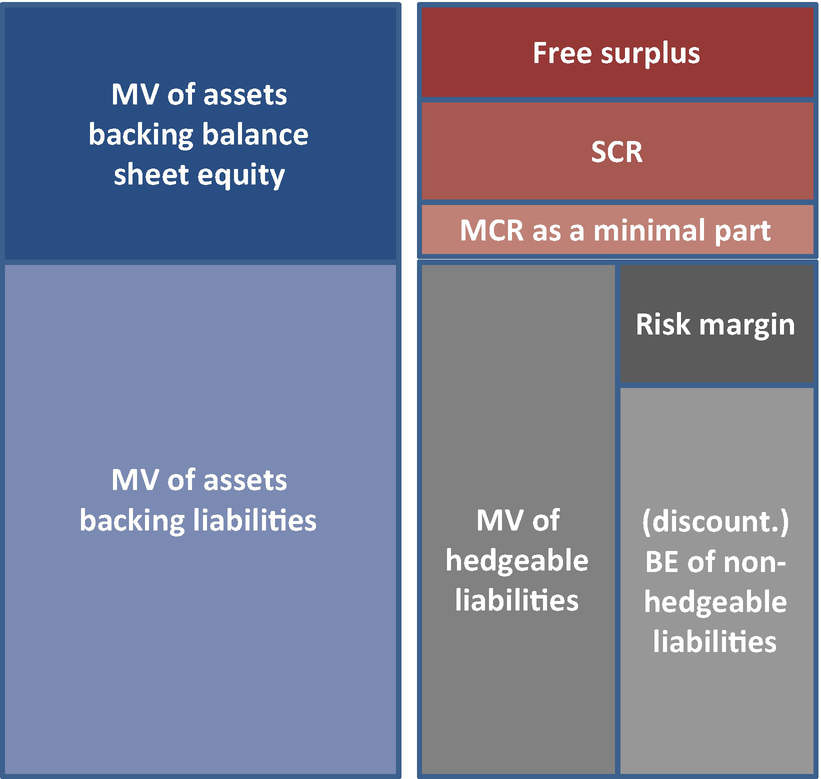

Insurance undertakings and authorised service providers may submit Solvency II reports to BaFin electronically using the BaFin reporting and publishing platform (Melde und Veröffentlichungsplattform – MVP Portal) The specialised procedure "Insurance Supervision Solvency II" consists of the following submissions. Solvency II BaFin updated notes on reporting information for primary and reinsurance companies under Solvency II It is addressed only to insurance companies and groups that are covered by the Solvency II regime. Solvency II Own Funds – The Economics of Market Consistent Valuation According to a study by Germany’s BaFin (Federal Financial Supervisory Authority), Own Funds for the German Life insurance industry decreased by about 127% in the first quarter of 16, mainly due to capital market developments.

BaFin published an “interpretative decision” on the evaluation of amounts recoverable from reinsurance contracts and special purpose vehicles (SPVs) under Solvency II The interpretative decision also addresses the handling of cash flows from settlement receivables and payables as well as deposit receivables and liabilities under Solvency II. The new supervisory regime Solvency II came into force in full on 1 January 16 The Solvency II Directive (Directive 09/138/EC) introduces advanced solvency requirements for insurers based on a holistic risk assessment, and imposes new assessment rules for assets and liabilities, which in future must be assessed at market values. Solvency II BaFin published an analysis of the Solvency and Financial Condition Report (SFCR) and the key figures separated by division The assessment shows that insurers meet requirements for Solvency II.

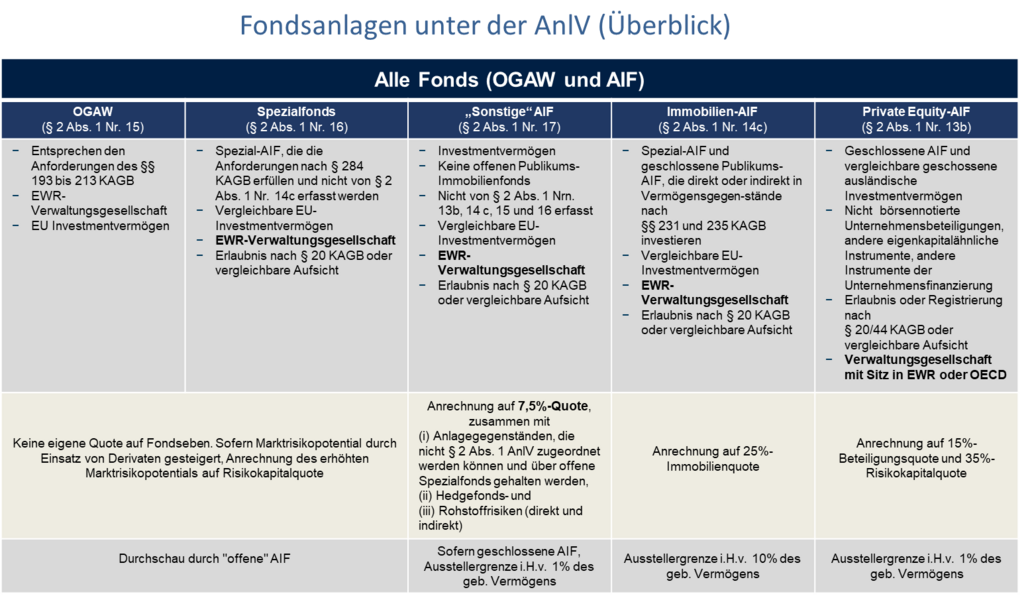

The German regulator, the BaFin, has published two consultation papers setting out proposals which will replace previous BaFin guidance affecting insurers and the funds sector The new consultation papers consider, for the first time, new regulatory requirements such as Solvency II and AIFMD and are intended to replace, in their respective. The Federal Financial Supervisory Authority (German Bundesanstalt für Finanzdienstleistungsaufsicht) better known by its abbreviation BaFin is the financial regulatory authority for GermanyIt is an independent federal institution with headquarters in Bonn and Frankfurt and falls under the supervision of the Federal Ministry of Finance (Germany)BaFin supervises about 2,700 banks, 800. ARAG awarded BaFin approval for its internal risk capital model The Bundesanstalt für Finanzdienstleistungsaufsicht (Federal Financial Supervisory Authority, BaFin) has approved and certified the internal risk capital model for the ARAG Group under Solvency II.

Dr Steffen is likely to provide a good behind Solvency II is to increase and Occupational Pensions Supervisors (CEIOPS), the key adviser to the European measures for Solvency II Under his direction, BaFin is about to introduce a new set of Supervisory Minimum Requirements for Risk Management by Insurance Undertakings. Solvency II, Regulatory Reporting EU BaFin published quarterly and annual submission deadlines on the Solvency II reporting page on its website The submission deadlines are for reporting years 19 to 25 for companies whose fiscal year ends on December 31. Solvency II Selected Key Elements of the EU Group Supervision under Solvency II 7 September 11 Lutz Oehlenberg Director Federal Financial Supervisory Authority –BaFin BaFin, Crosssector seminar on Supervisory Colleges, Berlin, 9 December 10 4 College of Supervisors.

BaFin published an "interpretation decision" related to the Solvency II supervisory regime and this decision is addressed to all insurers subject to the Solvency II supervisory regime The decision makes the clarifications about how insurance companies should examine the appropriateness of the valuation methodology for insurance reserves. Solvency II News BaFin considers Solvency 15 November 15, 12 Leave a comment The German regulator is discussing ways of adapting parts of Germany’s existing regulatory regime into its Solvency II preparations , according to Dr Elke König, President of BaFin. 4 Solvency II – Own Risk and Solvency Assessment (ORSA) Insurance and Reinsurance Stakeholder Group meeting 12 December 11 Solvency II ORSA Development process of EIOPA guidelines on ORSA General framework objectives and means details on the ORSA requirements Towards a formal opinion from the Insurance and Reinsurance Stakeholder Group Development process of EIOPA guidelines on ORSA.

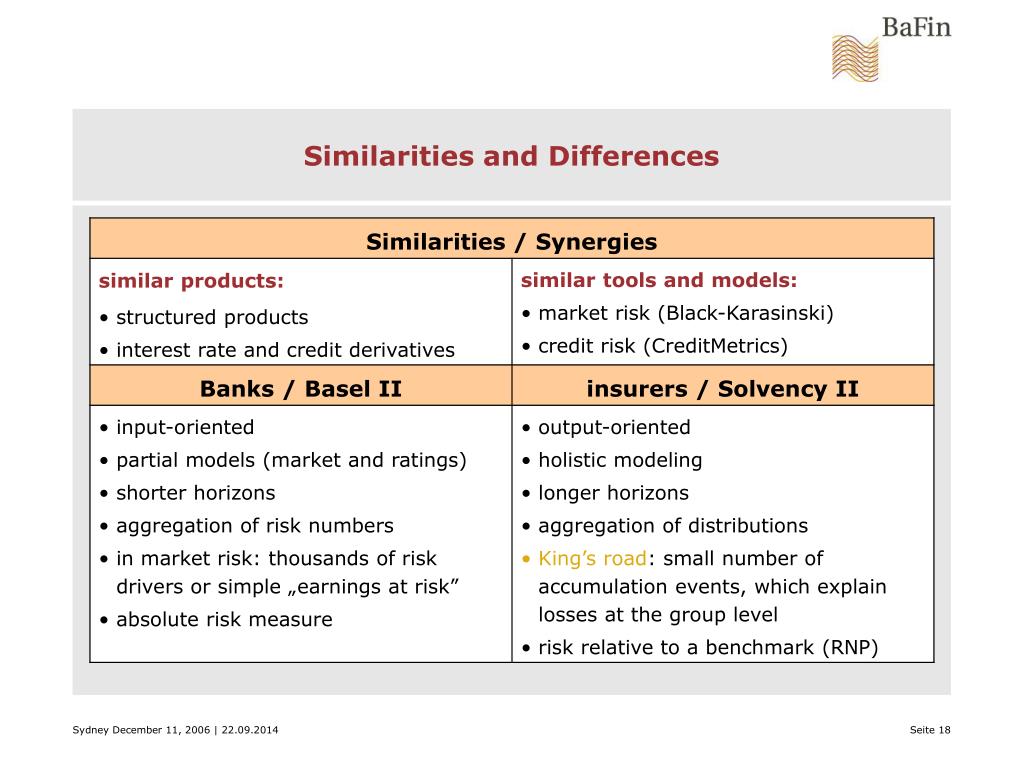

The German regulator, the BaFin, has published two consultation papers setting out proposals which will replace previous BaFin guidance affecting insurers and the funds sector The new consultation papers consider, for the first time, new regulatory requirements such as Solvency II and AIFMD and are intended to replace, in their respective. Solvency II is a complex supervisory regime for the EU (for an introduction see e g Gründl/Kraft 19 or Van Hulle 19), which is blueprint also for supervisory systems in other countries all over the world The Solvency II project discussions resulting in the introduction of the framework of Solvency II in 16 initiated rethinking. EFAMA’s tripartite template focuses on Solvency II reporting for Asset Managers to facilitate the data exchange with insurance/reinsurance undertakings It contains more than 140 fields needed for the solvency capital requirements calculation and the supervisory disclosures set out in the Pillars I and III of the Solvency II framework.

Solvency II Selected Key Elements of the EU Group Supervision under Solvency II 7 September 11 Lutz Oehlenberg Director Federal Financial Supervisory Authority –BaFin BaFin, Crosssector seminar on Supervisory Colleges, Berlin, 9 December 10 4 College of Supervisors. You can send such information anonymously to BaFin’s central contact point for whistleblowers Section 27 of the VAG Article 45 of the S II Framework Directive relates to the own risk and solvency assessment ORSAwhich is used, for example, to assess an undertaking’s overall solvency needs, taking into account its specific risk profile. An online repository for Solvency II, ERM and Corporate Governance material and comment from the Principal of Governance Matters, an independent Risk Consultancy firm based on the Isle of Man The Executive Director of insurance at BaFin, the German regulator, came out swinging late last week (while the rest of Europe was lotioning up), and.

Solvency II, Regulatory Reporting EU BaFin published quarterly and annual submission deadlines on the Solvency II reporting page on its website The submission deadlines are for reporting years 19 to 25 for companies whose fiscal year ends on December 31. BaFin updated notes on reporting information for primary and reinsurance companies under Solvency II It is addressed only to insurance companies and groups that are covered by the Solvency II regime The updated notes are divided into a section on general introduction into the subject matter, detailed notes on quantitative and narrative. Solvency II Own Funds – The Economics of Market Consistent Valuation According to a study by Germany’s BaFin (Federal Financial Supervisory Authority), Own Funds for the German Life insurance industry decreased by about 127% in the first quarter of 16, mainly due to capital market developments.

Solvency II – Analysts’ briefing 4 The road to Solvency II on the final straight Solvency II regime becomes fully applicable on 1 January 16 Preparatory phase 14–15 successfully concluded Level 1, 2 and 3 documents finalised and mainly approved Currently being transposed into national law. Solvency II BaFin published an analysis of the Solvency and Financial Condition Report (SFCR) and the key figures separated by division The assessment shows that insurers meet requirements for Solvency II. Solvency II is implemented in Europe through a combination of the earlier Solvency II Framework Directive and the later Omnibus II Directive The framework requires each applicable national regulator to transmit data in XBRL (used as a common format and common data model) to the European Insurance and Occupational Pensions Authority (EIOPA).

BaFin also expects Solvency II insurance companies to have an appropriate risk culture In the course of the revision of the MaGo circular (02/17), which has been planned after completion of the Solvency II review, the corresponding section will therefore also be included in this circular, which applies to Solvency II companies. The current Solvency II review is a case in point The EU Commission mandated the European Insurance and Occupational Pensions Authority EIOPA to perform this review, which is due for completion by mid It is an extensive exercise covering capital requirements, reporting, proportionality and everything in between. Solvency II BaFin is consulting on the reporting form and the notes on the data to be reported to demonstrate adequate capital adequacy at the level of a financial conglomerate BaFin published the draft of a circular and a notification form.

In assessing the applications, BaFin applies the provisions under the Solvency II Directive (in particular Articles 308c and 308d) and the relevant supplementary EIOPA Guidelines. Solvency II BaFin is consulting on the reporting form and the notes on the data to be reported to demonstrate adequate capital adequacy at the level of a financial conglomerate BaFin published the draft of a circular and a notification form. BaFin published an "interpretation decision" related to the Solvency II supervisory regime and this decision is addressed to all insurers subject to the Solvency II supervisory regime The decision makes the clarifications about how insurance companies should examine the appropriateness of the valuation methodology for insurance reserves.

Solvency II, Regulatory Reporting EU BaFin updated notes on Solvency II reporting for insurance and reinsurance companies and insurance groups The updated document is binding for the 19 annual reporting and quarterly reporting from the first quarter of. Solvency II, Regulatory Reporting EU BaFin updated notes on Solvency II reporting for insurance and reinsurance companies and insurance groups The updated document is binding for the 19 annual reporting and quarterly reporting from the first quarter of. An initial review by BaFin shows that the Solvency II own funds of insurers are increasing and that the undertakings can provide conclusive explanations for most of the variations in own funds.

The capital adequacy ratio – or Solvency II ratio – expresses how robustly the capital requirements that may arise upon occurrence of an extreme scenario are covered by the company's own funds. In a recent report by Germany’s regulator BaFin urges insurers to improve their Orsa reporting for 18 As early as the Solvency II preparatory phase, the companies were asked to go through a reduced form of the ORSA that took into account the fact that the quantitative Solvency II requirements had not yet been met. Regulate the financial solvency of its domestic reinsurers in comparison to key principles underlying the US financial solvency framework and other factors set forth in the Evaluation Methodology The Working Group considered the following information with respect to evaluation of BaFin.

Solvency II News BaFin considers Solvency 15 November 15, 12 Leave a comment The German regulator is discussing ways of adapting parts of Germany’s existing regulatory regime into its Solvency II preparations , according to Dr Elke König, President of BaFin.

Www Imf Org External Pubs Ft Scr 16 Cr Pdf

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Lessons From Implementations Of Basel Ii And For

Bafin Solvency Ii のギャラリー

Solvency Ii Bilanz Der Bafin Durchfallquote 0 9 Prozent Finanznachrichten Auf Cash Online

Germany Germany Financial Sector Assessment Program Detailed Assessment Of Observance On Insurance Core Principles

Finanznachrichten Versicherungen Solvency Ii Drei Versicherer Patzen

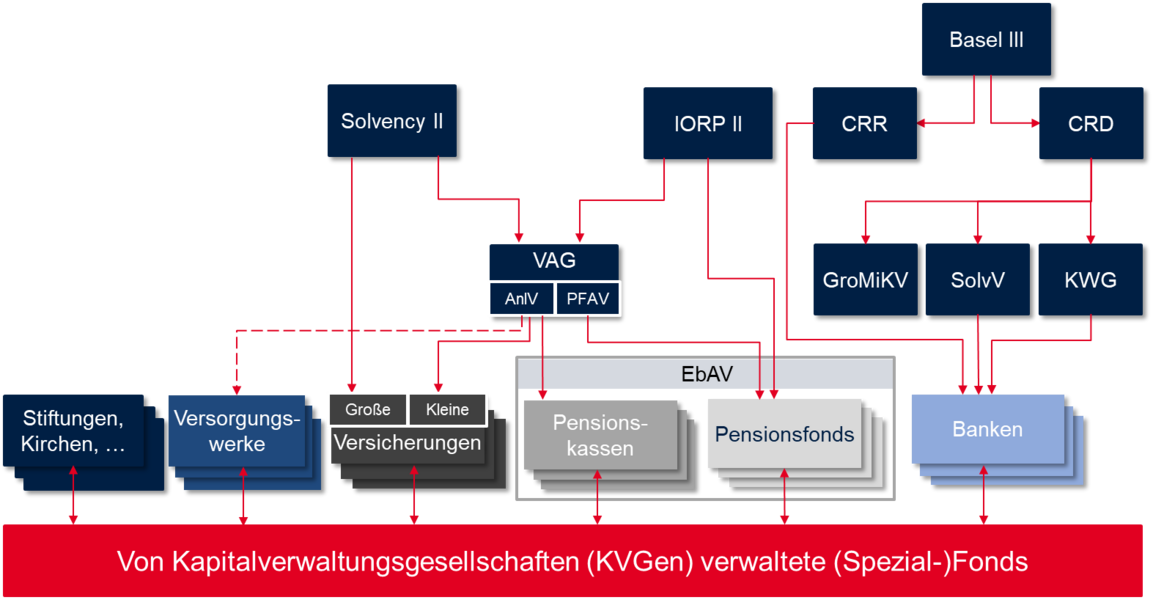

Supervisory Law For Investors Solvency Ii Vag Anlv Bundesverband Alternative Investment Ev Home

Germany Germany Financial Sector Assessment Program Detailed Assessment Of Observance On Insurance Core Principles

Content Naic Org Sites Default Files Inline Files Bafin letter and guidance Pdf

Bafin Recht Regelungen Zerlegung Des Scr In Der Schaden Unfallversicherung

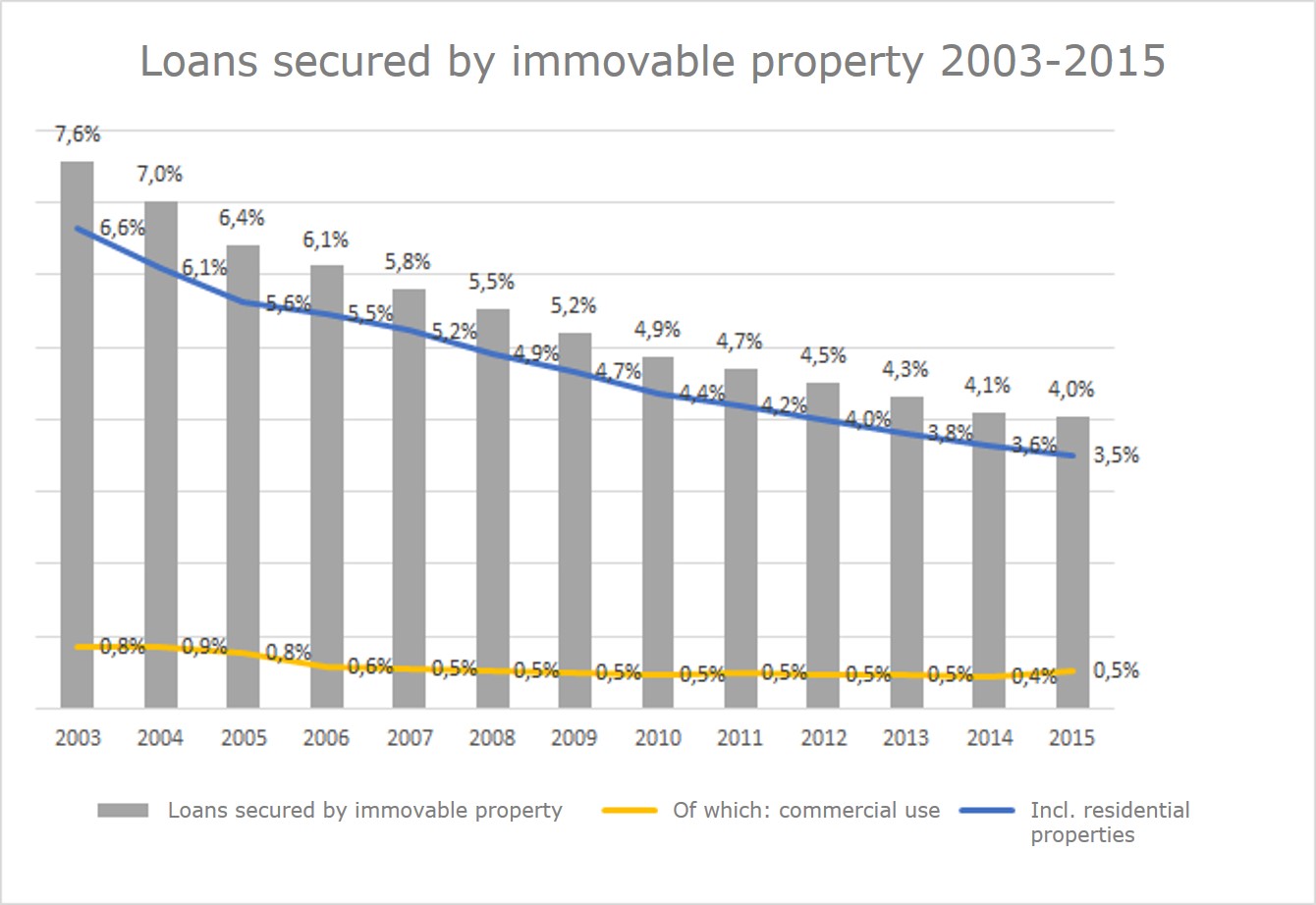

Bafin Expert Articles Mortgage Loans Insurers Traditional Business Line Influenced By

Bafin Expert Articles Bafin Adapts Requirements To The Crisis

Bafin Law Regulation Legislative Process Up To The Implementation Of Solvency Ii

Solvency Ii Pillar 3 Pension Fund Reporting Solution Regtech

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Bafin Expert Articles Proportionality In Insurance Supervision

Bafin Publishes Monthly Roundup Focus On Psd 2 Solvency Ii And Financial Advice Planet Compliance

Germany Germany Financial Sector Assessment Program Detailed Assessment Of Observance On Insurance Core Principles

Deutsche Lebensversicherer Erfullen Solvency Ii Vorgaben Asscompact News Fur Assekuranz Und Finanzwirtschaft

-bafin.jpg)

Bafin Erhebung Deutsche Lebensversicherer Fur Solvency Ii Gerustet Vertrieb 12 11 14 Fonds Professionell

.jpg)

Bafin Bei Solvency Ii Muss Nachjustiert Werden Bocquell News De

Aba Questions Bafin S Risk Assessment Requirements For Pension Schemes News Ipe

Germany Bonn 06 07 Press Conference Of The Bafin The Federal Financial Supervisory Stock Photo Picture And Rights Managed Image Pic Vig Agefotostock

Bafin Expert Articles Solvency Ii Quality Progress In Solvency And Financial Reporting

Bafin S Focus On Regtech Just Another Summary Or Something To Talk About Planet Compliance

Solvency Ii Risk And Regulatory Reporting Secondfloor

Supervisors Face The Flood Of Solvency Ii Data Insuranceerm

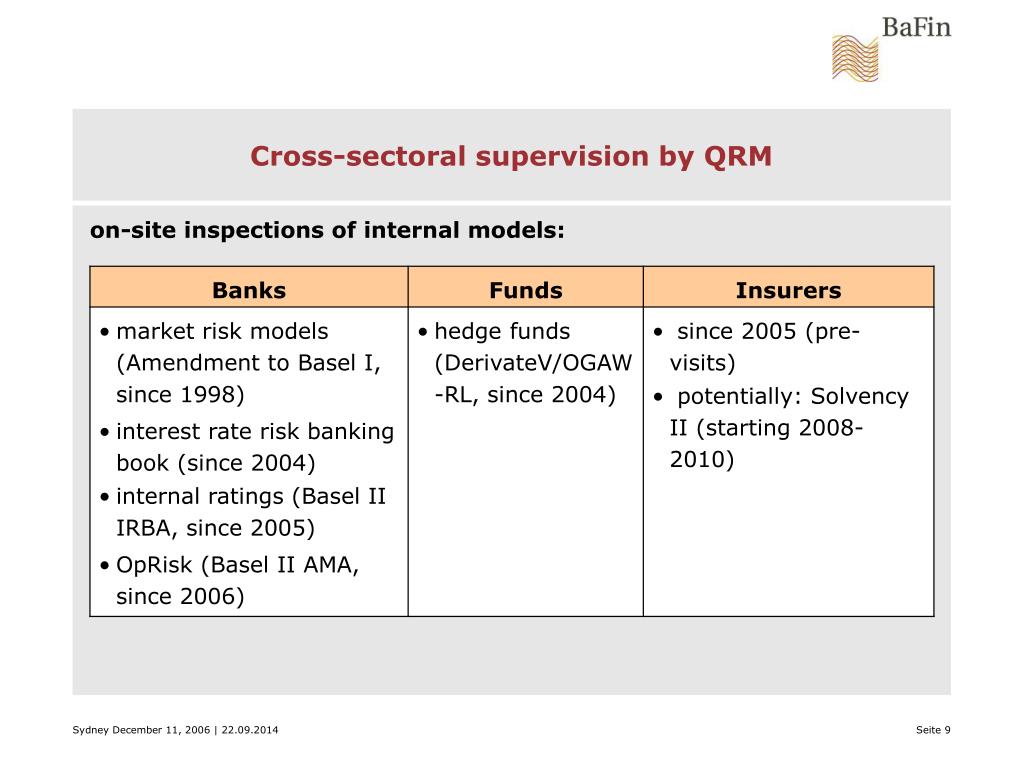

Ppt Lessons From Implementations Of Basel Ii And For Solvency Ii Workshop Sydney 06 Manley Beach Powerpoint Presentation Id

Www Cooperazionepuma Com Media Interviste Documenti Interviste 15 15 09 10 Erm Intervista Corinti Insuranceerm Pdf

Bafin Solvency Ii Standardmodell Soll Govies Risiken Berucksichtigen Regulierung 07 16 Institutional Money

Bafin Recht Regelungen Schadenruckstellung Nach Hgb Und Solvency Ii

Solvabilitat Bafin Veroffentlicht Erste Zahlen Zu Solvency Ii Autohaus De

Replay Solvency Ii Review Challenges And Opportunities Federation Francaise De L Assurance

Update Investorenaufsichtsrecht Kapitalanlagerundschreiben Und Solvency Ii Private Equity Magazin

Vsav Bafin Soll Die 3 Solvency Ii Sunder Nennen

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Www Pwc Com Gx En Financial Services Pdf Solvency Ii Template Pdf

Finanznachrichten Versicherungen Bafin Solvency Ii Ist Ein Jahrhundertwerk

Bafin Expert Articles Well Founded Not Artificially Constructed

Aufsichtsrechtlicher Dialog Und Sanktionen Der Bafin

Solvency Ii Review High Level Discussion About Challenges And Opportunities

Bafin Chefin Elke Konig Aussert Sich Zu Deutschen Banken Und Solvency Ii Markt Versicherungsbote De

Introduction Springerlink

Bafin Overview Competitors And Employees Apollo Io

Introduction Springerlink

Liquidity Risk A Challenging Issue For The Supervisory Community Gerhard Stahl Bafin Ppt Download

Why Iam Is The Leading Solution For The Financial Institutions Patecco En

Www Cliffordchance Com Content Dam Cliffordchance Briefings 01 Iru 23 December 19 03 January Pdf

A New Legal Model For Blockchain Based Insurance By Etherisc Etherisc Blog

Www Cms Lawnow Com Media Files Regzone Reports Smart Pdf Regzone Bafin Guidance On German Anti Money Laundering Act For Insurance Companies Pdf Rev D7a5396a 6c91 43c5 8cf3 Cbbc5ac Cc Lang En

Www Bafin De Shareddocs Downloads En Dl Mvp Portal Infoblatt Fachverfahren Va Solvencyii En Pdf Blob Publicationfile V 4

2

Bafin Verschont Kleinere Versicherer Und Pensionskassen Bei Solvency Ii Markt Versicherungsbote De

Germany Germany Financial Sector Assessment Program Detailed Assessment Of Observance On Insurance Core Principles

Germany Germany Financial Sector Assessment Program Detailed Assessment Of Observance On Insurance Core Principles

Germany Germany Financial Sector Assessment Program Insurance Sector Supervision Technical Notes

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Artikelubersicht Probezugangsbereich Solvency Ii

2

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

The Legal Impact Of Non Binding Regulatory Acts Planet Compliance

Bafin Bafinperspectives Bafinperspectives Issue 2 19

Bafin Erhebung So Gut Sind Lebensversicherer Fur Solvency Ii Gerustet Asscompact News Fur Assekuranz Und Finanzwirtschaft

Www Bafin De Shareddocs Downloads En Dl Mvp Portal Infoblatt Fachverfahren Va Solvencyii En Pdf Blob Publicationfile V 4

Solvency Ii Berichtswesen Versicherer Erfullen Vorgabe Bocquell News De

Auf Versicherungsunternehmen Kommen Neue Regeln Zu

Lebensversicherer Sind Auf Solvency Ii Vorbereitet

2

Solvency Ii News May 12

Gemeinsames Buch Von Bafin Und Hochschule Zum Kapitalanlagemanagement Hochschule Der Deutschen Bundesbank

Bafin All Issues Of Bafinperspectives

Ppt Lessons From Implementations Of Basel Ii And For Solvency Ii Workshop Sydney 06 Manley Beach Powerpoint Presentation Id

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Finanznachrichten Berater Solvency Ii Muss Bafin Informationspolitik Andern

Supervisory Law For Investors Solvency Ii Vag Anlv Bundesverband Alternative Investment Ev Home

Bafin Expert Articles There Already Is A Small Insurance Box Dr Frank Grund On Solvency

Versicherungsaufseher Verschieben Solvency Ii Plane

Www A Zn Si Wp Content Uploads Presentation09 Pdf

Solvency Ii News May 12

Vor Antragsprozess Fur Interne Modelle Archives Insurance

Bafin Discussion Topic One Year Of Solvency Ii In Practice

Solvency Ii Eigenkapitaldecke Der Lebensversicherer Wird Dunner Produkte 10 08 16 Fonds Professionell

Ppt Lessons From Implementations Of Basel Ii And For Solvency Ii Workshop Sydney 06 Manley Beach Powerpoint Presentation Id

Bafin Sieht Lebensversicherer Fur Solvency Ii Gerustet Sparten Versicherungsbote De

Bafin Technical Cooperation Financial Reporting Under Solvency Ii Eu Taiex Workshop For The Ministry Of Finance Of Azerbaijan Ppt Download

Bafin Erhebung Deutsche Lebensversicherer Fur Solvency Ii Gerustet Versicherungsmagazin De

Www Jstor Org Stable

Replay Solvency Ii Review Challenges And Opportunities Federation Francaise De L Assurance

Bafin Veroffentlicht Zeitplan Fur Solvency Ii Vorbereitung Markt Versicherungsbote De

Bafin Drei Versicherern Fehlt Das Notige Eigenkapital Fur Solvency Ii Praxis Versicherungsbote De

Bafin Expert Articles Mifid Ii In Practice

Bafin Expert Articles Mifid Ii In Practice

Solvency Ii News May 12

Ppt Lessons From Implementations Of Basel Ii And For Solvency Ii Workshop Sydney 06 Manley Beach Powerpoint Presentation Id

Supervisory Law For Investors Solvency Ii Vag Anlv Bundesverband Alternative Investment Ev Home

Pdf Yes We Can Control Them Regulatory Agencies Trustees Or Agents

Bafin Plant Verscharfte Prufungshandlungen Fur Versicherer Versicherungswirtschaft Heute

The Cost Of Inaction Recognising The Value At Risk From Climate Change By Fam Robert Bleeker Issuu

Www2 Deloitte Com Content Dam Deloitte Lu Documents Financial Services Lu Bafin Published New Circular Capital Investment Ordinance Pdf