Coca Cola Dividende

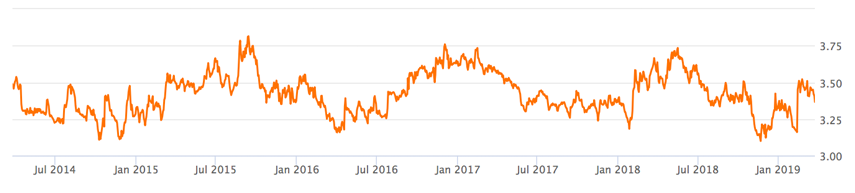

Dividend Cover 119 1 52Week Projected Yield 321% 52Week Trailing Yield 330% 6Year Average Yield 328% 6Year Dividend Change 1571% 6Year Yearly Dividend Change 262% Number of Dividend Payments ( 1130) 114.

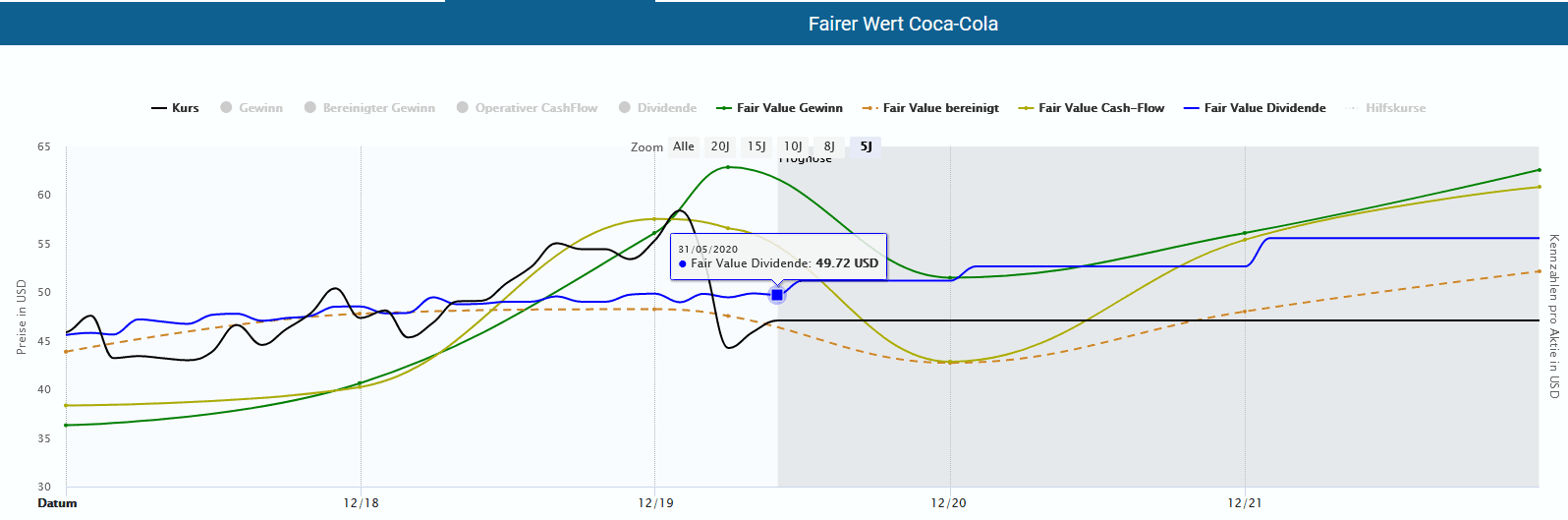

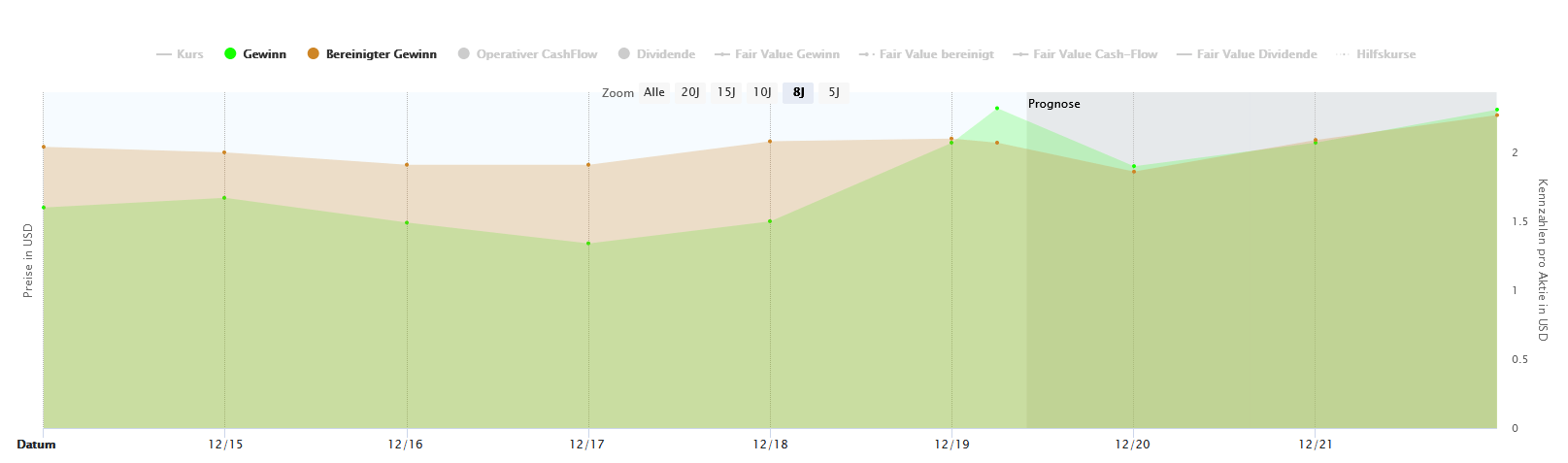

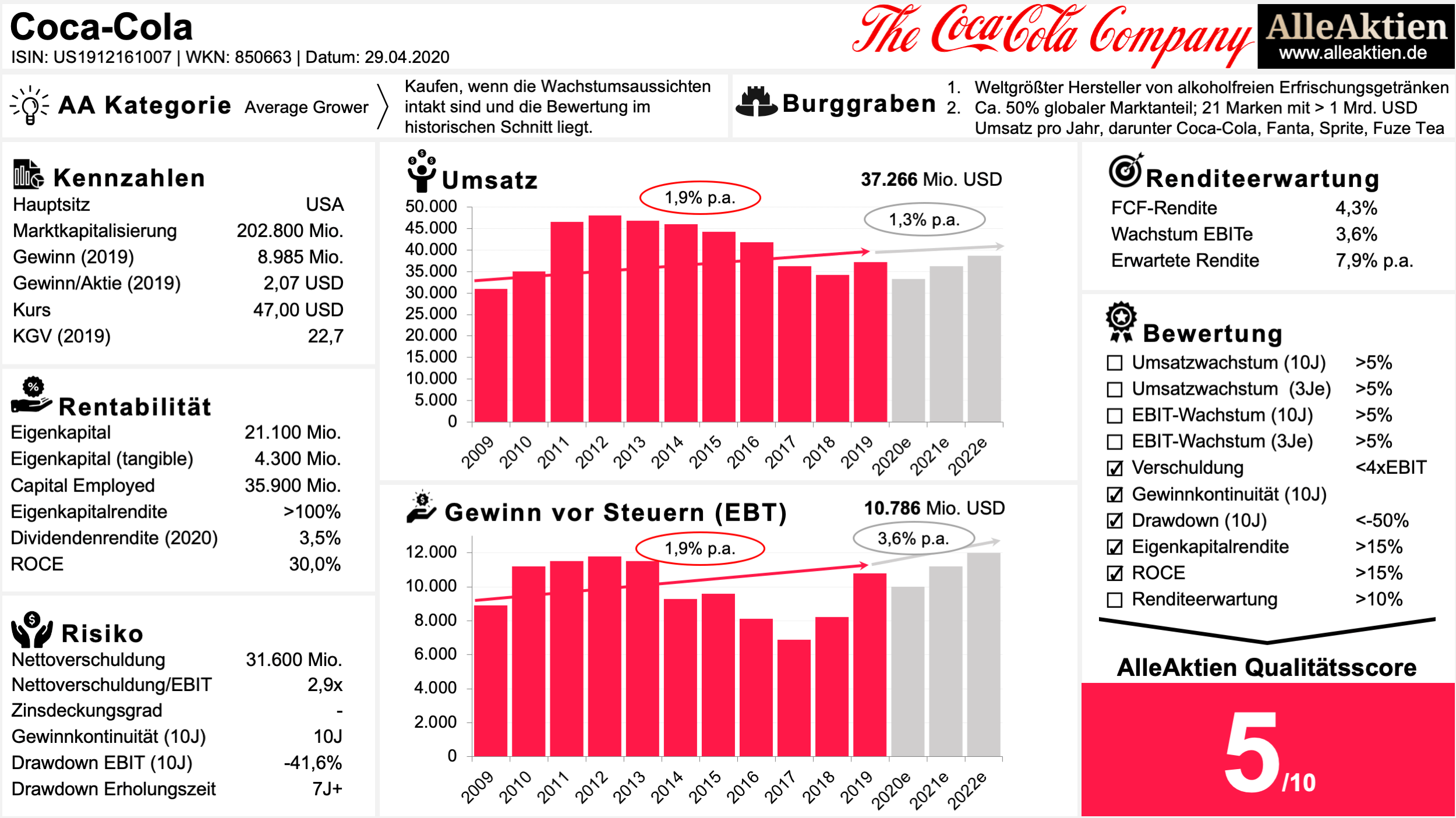

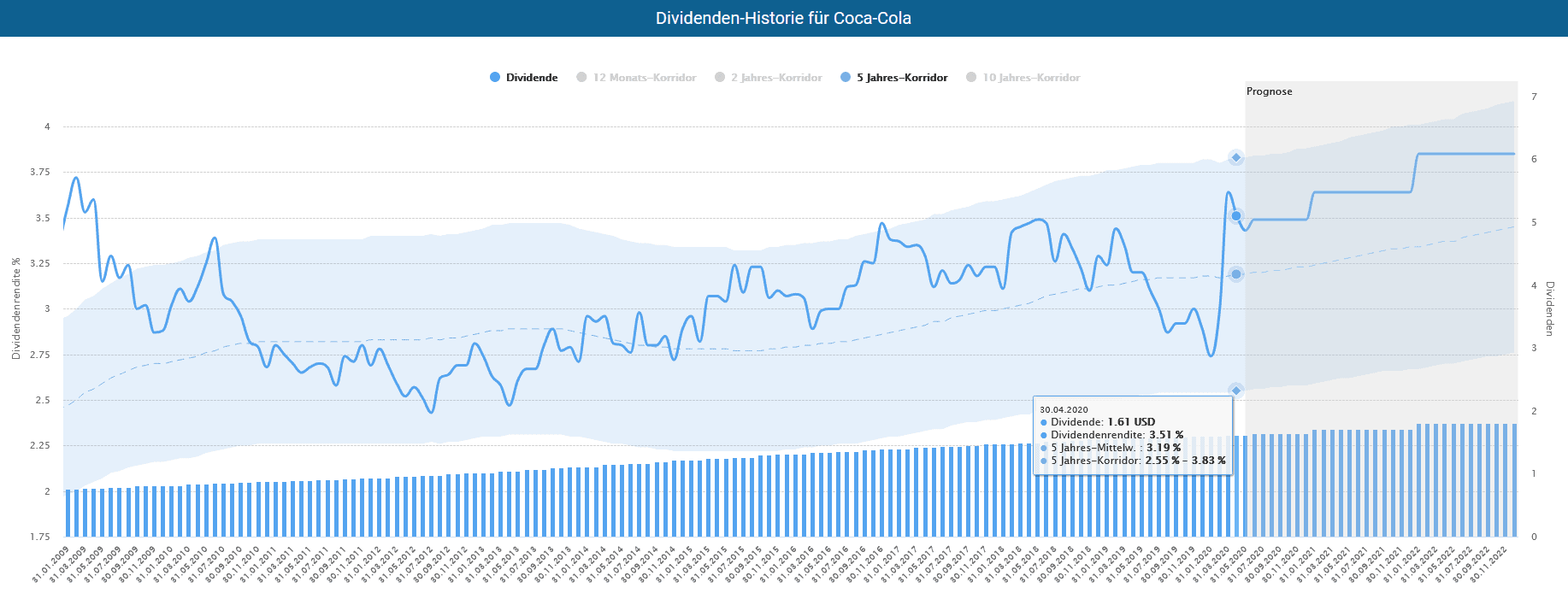

Coca cola dividende. Find the latest dividend history for CocaCola Company (The) Common Stock (KO) at Nasdaqcom. CocaCola’s dividend is a huge draw for investors The company is a Dividend King and currently yields 3%, so its pedigree as an income stock is impeccable The company’s current payout is $040 per share quarterly, good for $160 annually. Although it yields a solid 335%, the dividend growth has been slowing down The 5yr CAGR growth is still above my minimum criteria of 5%, but the latest raise was just 25% At the same time, the FCF payout ratio has been climbing Current dividend payments now make up almost 85% of 19 FCF.

Updated Last Close Price $4870 Yield 337% Payout Ratio PE Ratio 256 Market Cap 929B Frequency Quarterly Dividend History (adjusted for. 52Week Trailing Yield 330% 6Year Average Yield 328% 6Year Dividend Change 1571% 6Year Yearly Dividend Change 262% Number of Dividend Payments ( 1130). CocaCola (NYSEKO) declares $037/share quarterly dividend, 57% increase from prior dividend of $035 Forward yield 361% Payable April 3;.

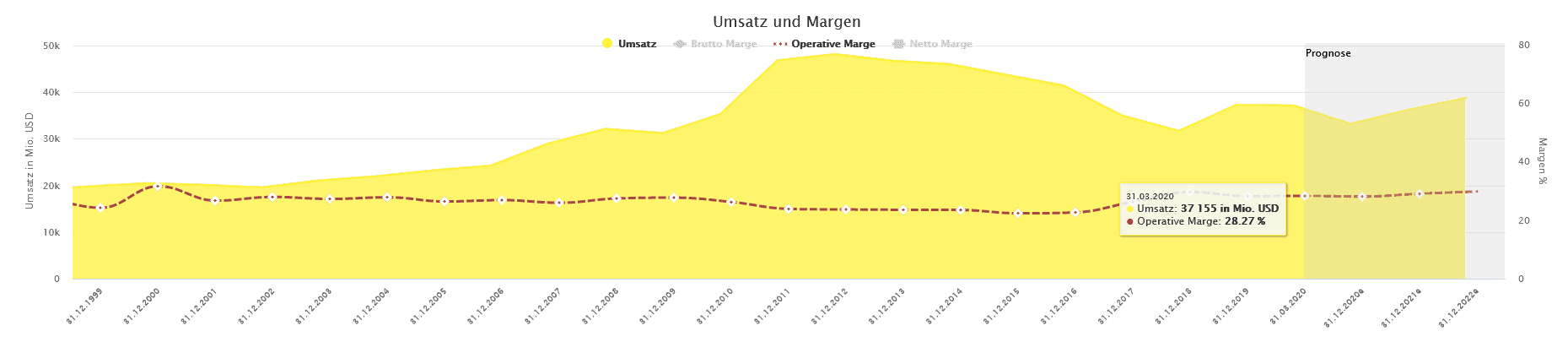

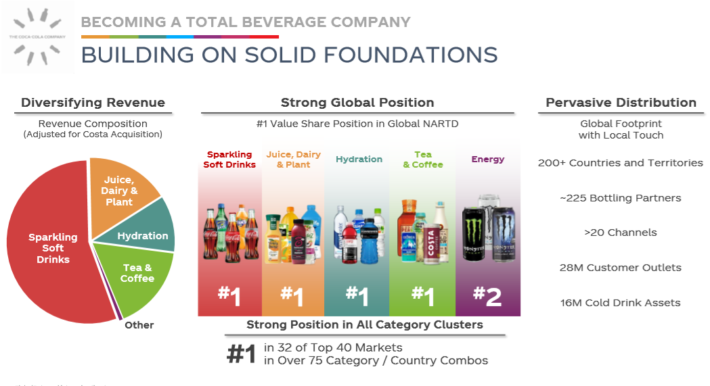

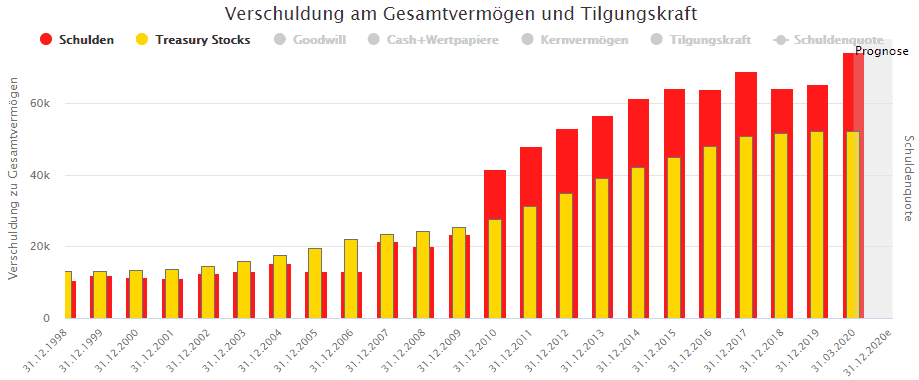

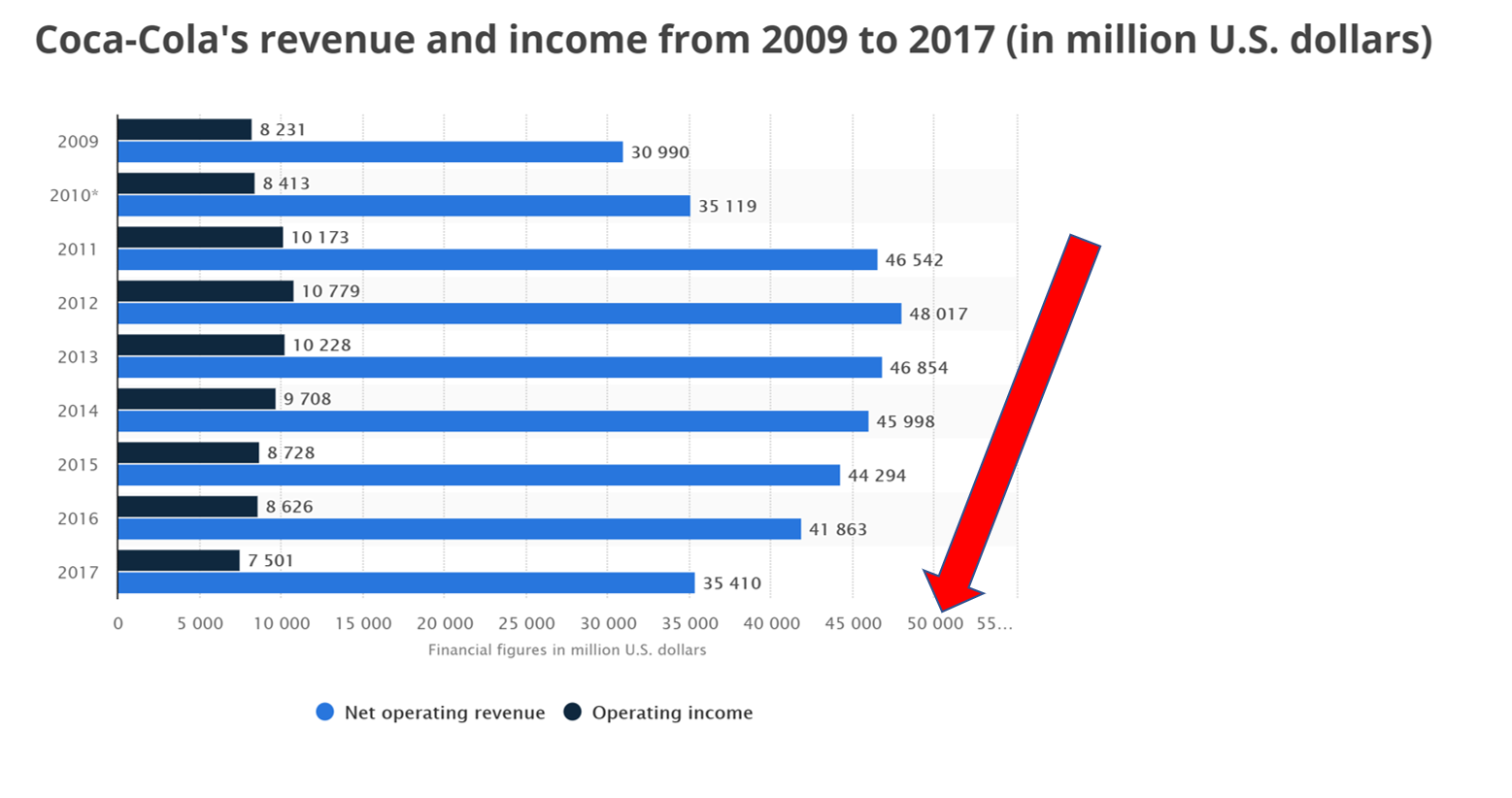

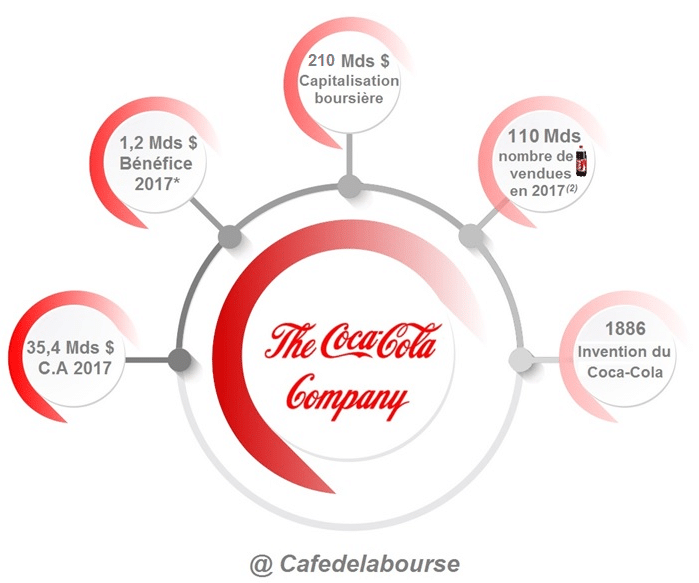

The CocaCola Company Is A King Of Dividend Growers The CocaCola Company is running a 90% payout ratio on its 328% yield which suggests a dividend cut may be in order The mitigating factors are that this company is a Dividend King with 58 years of annual increases, the payout ratio isn’t as bad as it looks, and the balance sheet is in good shape. Based on its share price of $5972 on Feb , CocaCola currently has a dividend yield of 27% Moreover, the company’s current dividend payout ratio is 773% Dividend payouts are the biggest. CocaCola (KO) A Dividend King That’s Still A Buy Overview of CocaCola CocaCola traces its roots to 16 It is the largest nonalcoholic beverage company in the world CocaCola’s Market Dominance CocaCola has the No 1 or No 2 market position in almost all its categories CocaCola Risks.

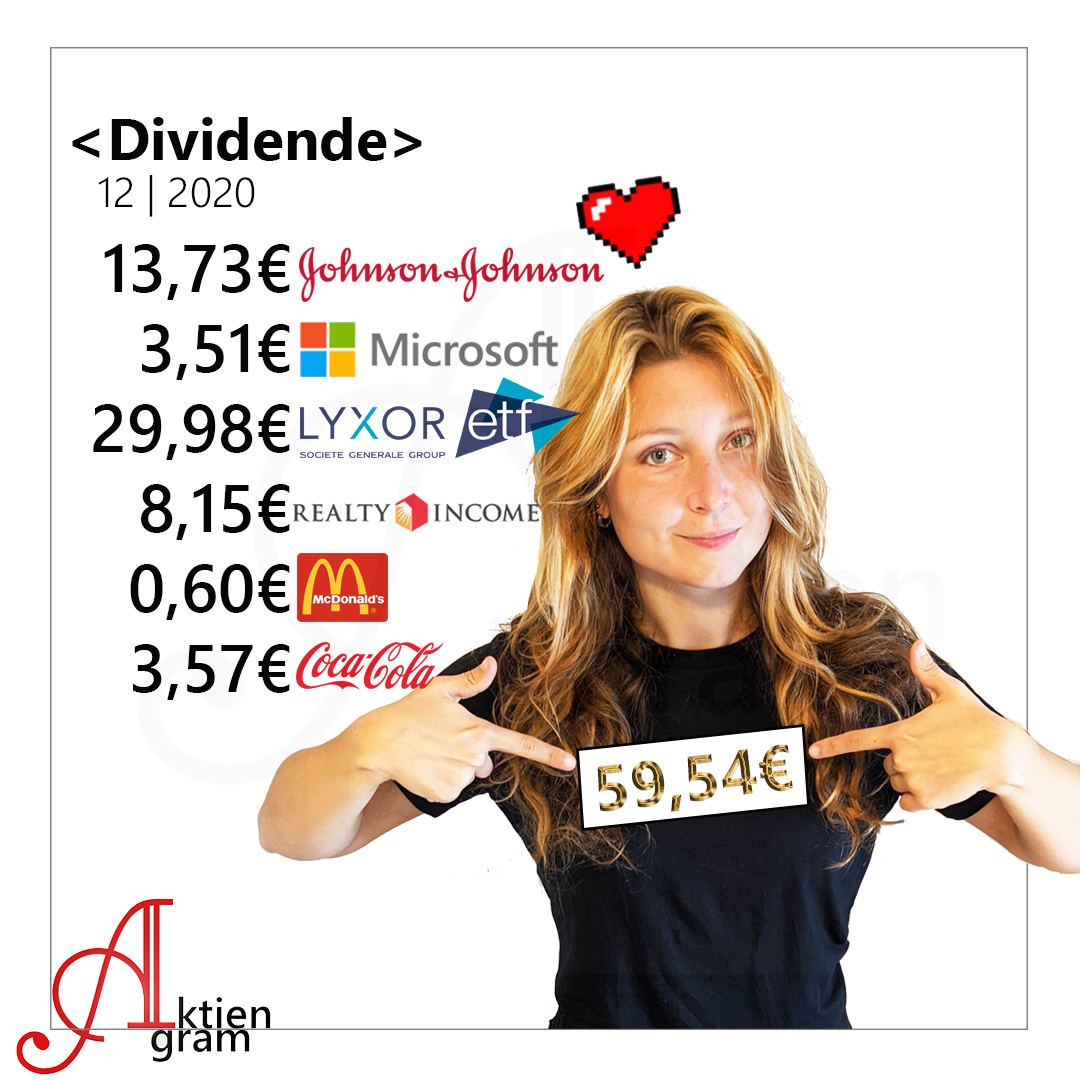

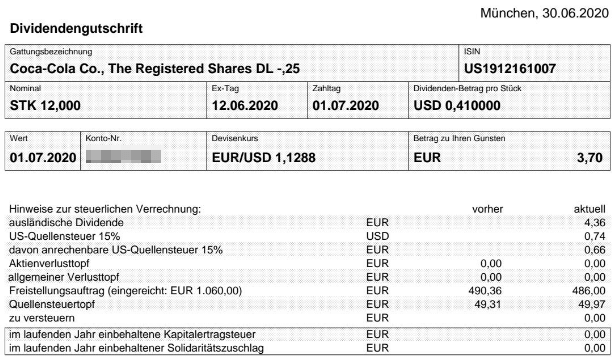

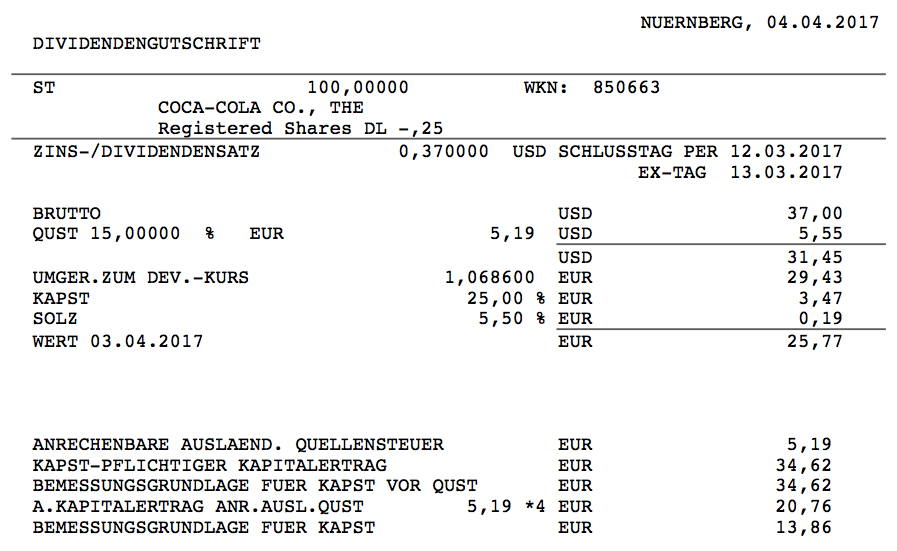

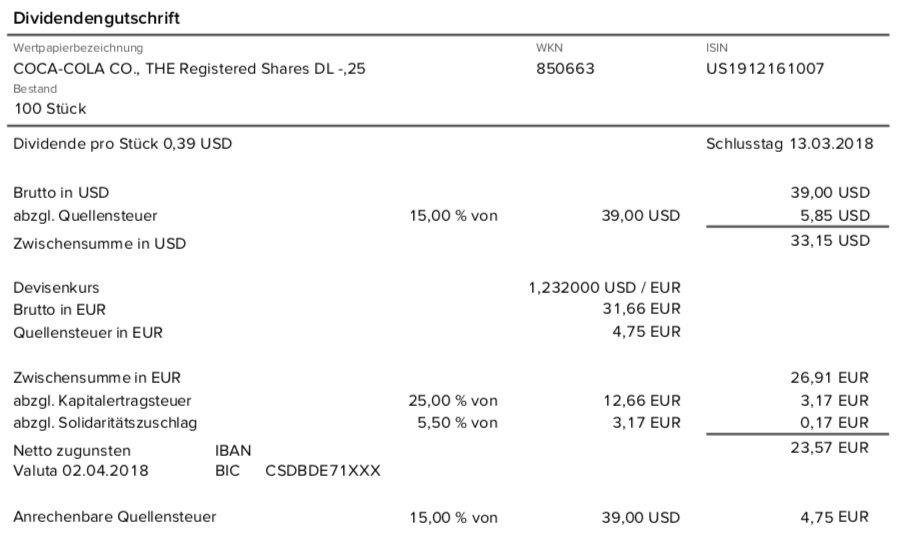

CocaCola schüttet vier Mal im Jahr eine Dividende aus Dies ist immer im April, Juli, Oktober und Dezember der Fall Die nun ausgeschüttete Dividende betrug wie bereits in den letzten beiden Quartalen $0,41 je Aktie Dies entspricht einer Steigerung von 2,5% im Vergleich zum Vorjahr PErsönlich Ich habe 100 Anteile von CocaCola in meinem. CocaCola Dividend Policy The definition of dividend is as follows A dividend is the distribution or sharing of parts of profits to a company 's shareholders Now the question is why do companies pay dividends to it s shareholders?. CHARLOTTE, NC, Jan 08, 21 (GLOBE NEWSWIRE) CocaCola Consolidated, Inc (NASDAQ COKE) announced that the Board of Directors has declared a dividend for the first quarter of 21 of $025.

Dividend payouts are the biggest enticement for investors and CocaCola is committed to boosting shareholders’ wealth Notably, it is a windowsandorphan stock, with a long history of regular. The dividend yield measures the ratio of dividends paid / share price Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks Companies that pay dividends tend to have consistent. CocaCola Dividend History and Safety written by Robert Otman Friday, October 5, 18 The CocaCola (NYSE KO) dividend history is long and reliable The stock has made a great addition to many income portfolios Let’s check out the business, dividend history and payout safety going forward.

CHARLOTTE, NC, Jan 08, 21 (GLOBE NEWSWIRE) CocaCola Consolidated, Inc (NASDAQ COKE) announced that the Board of Directors has declared a dividend for the first quarter of 21 of $025 per share on shares of the Company's Common Stock and Class B Common Stock payable on February 5, 21 to shareholders of record as of the close of business on January 22, 21. In depth view into CocaCola Dividend including historical data from 1972, charts, stats and industry comps. A stock’s Dividend Uptrend rating is dependent on the company’s pricetoearnings (P/E) ratio to evaluate whether or not a stock’s dividend is likely to trend upward If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock’s dividend to increase.

The latest from CocaCola Amatil's financial half year, full year results and market updates Financial reporting Explore CocaCola Amatil's annual and tax transparency reports here. About The CocaCola Company The CocaCola Company (NYSE KO) is a total beverage company, offering over 500 brands in more than 0 countries and territories In addition to the company’s CocaCola brands, our portfolio includes some of the world’s most valuable beverage brands, such as AdeS plantbased beverages, Ayataka green tea, Costa. For shareholders of record March 15;.

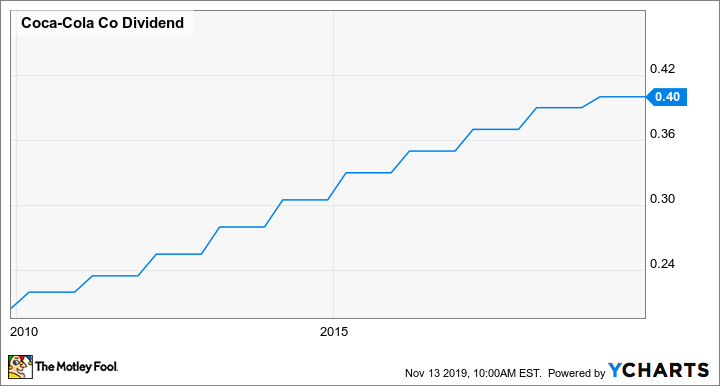

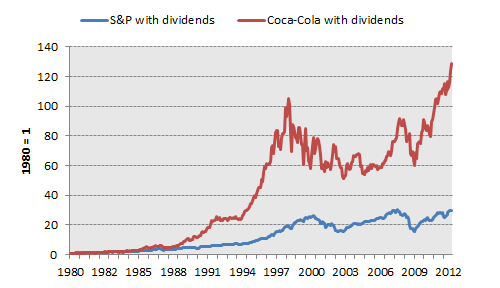

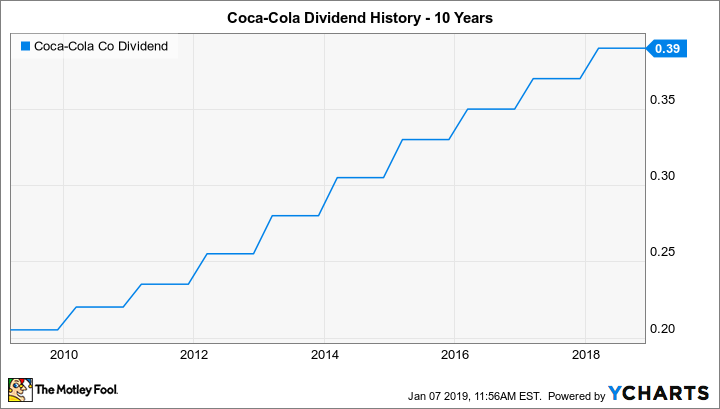

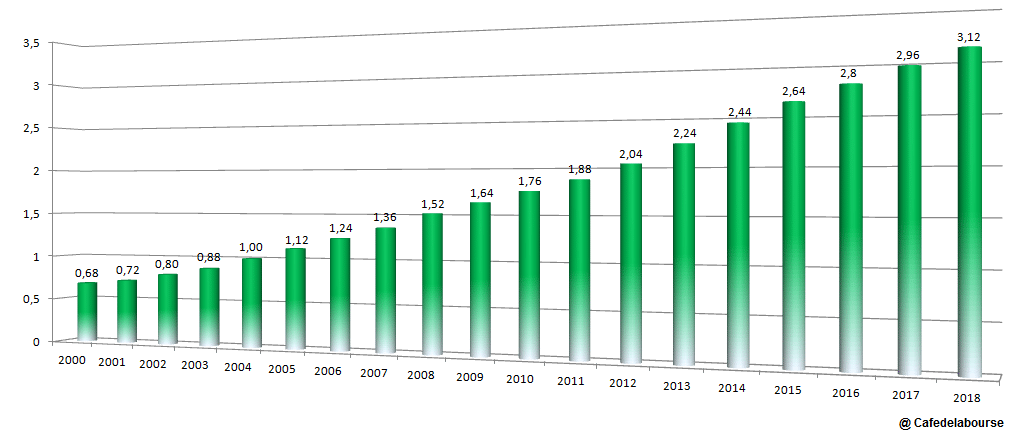

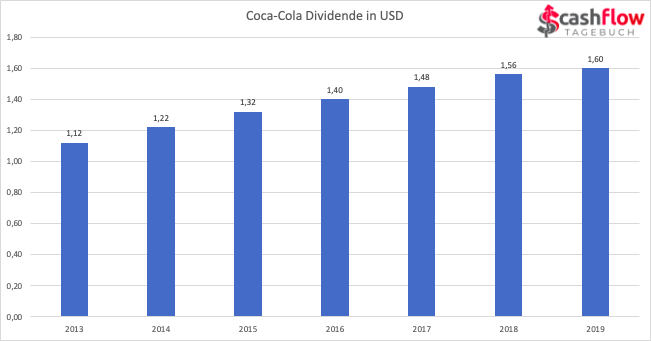

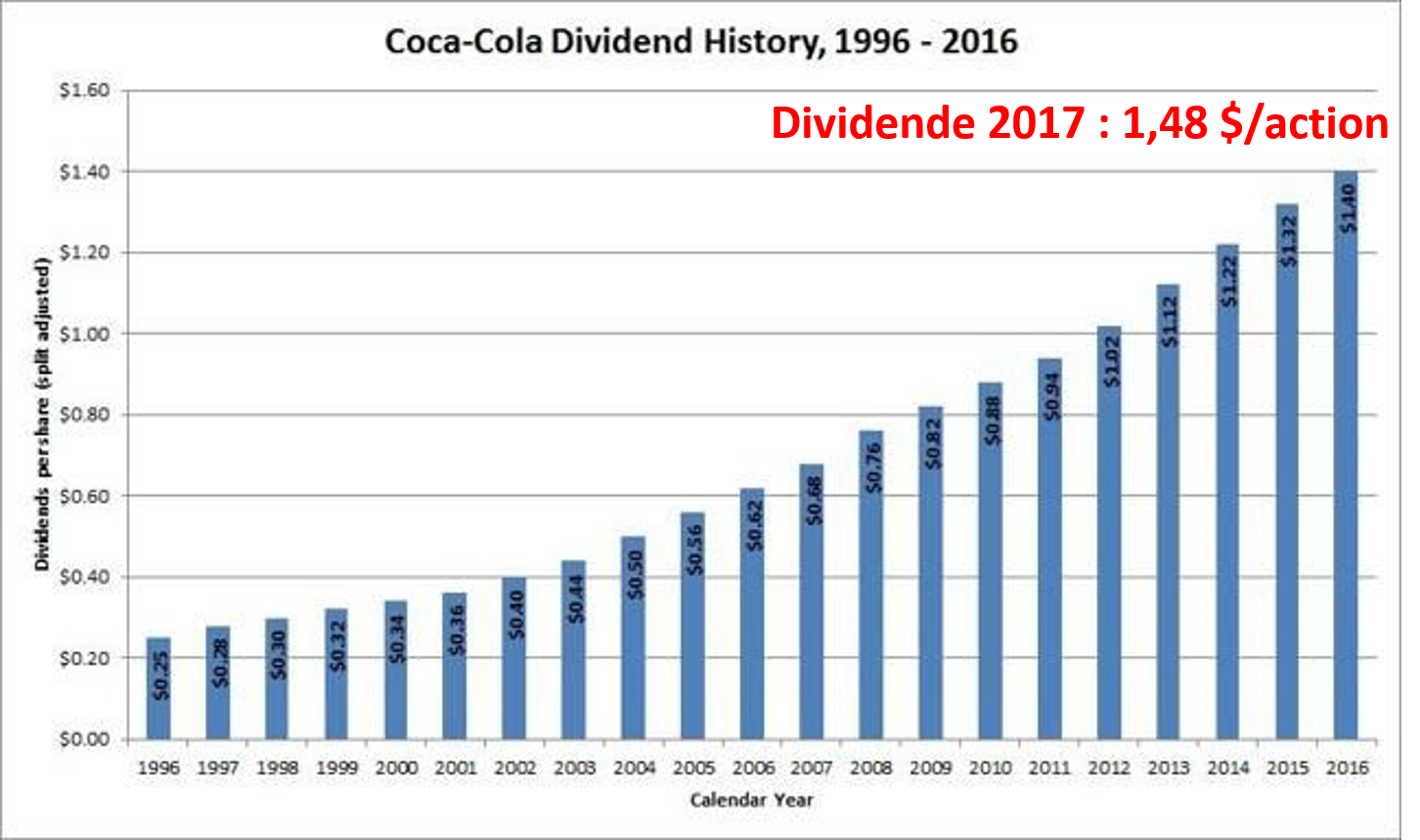

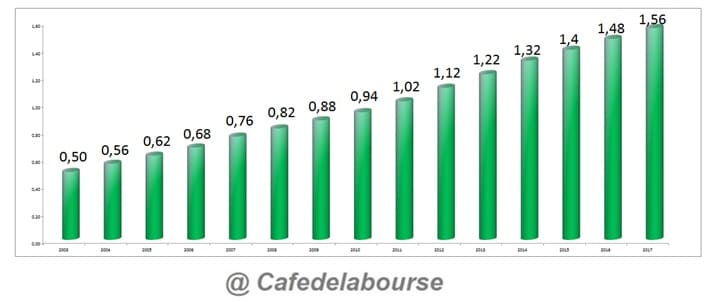

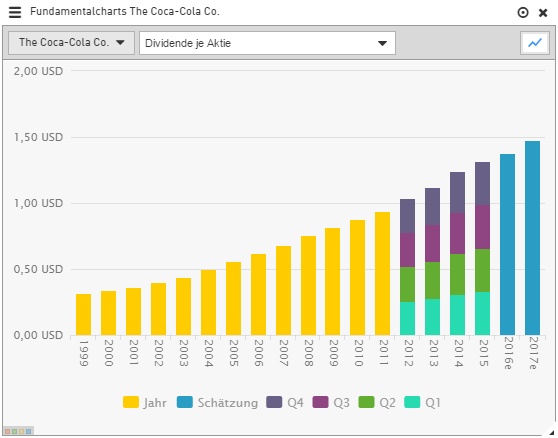

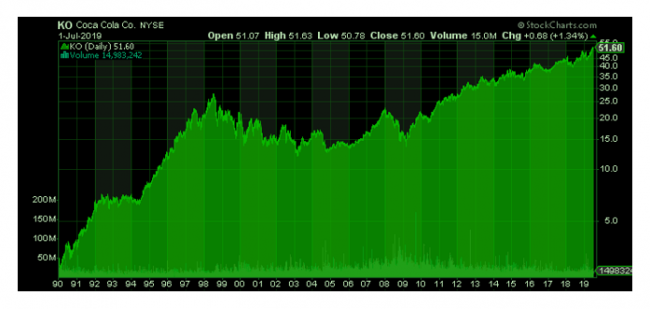

CocaCola Aktie Dividenden Die CocaCola Dividende wird auf der Jahreshauptversammlung für das abgelaufene Geschäftsjahr festgelegt Dabei schlägt der Vorstand die Dividendenhöhe vor. This iconic branded company has been around for 130 years and is also coined as one of the, “Dividend Aristocrats”, having increased their dividend for 25 years In fact, this iconic company has delivered a streak of 55 years of increasing their dividend Yes, I am talking about The CocaCola Company ( KO ). Coca Cola has grown its dividend from just 10 cents a share in 1990 to $160 in 19 This represents a compounded annual growth rate of 97% over 30 years Attached is a chart showing the steady uptrend in Coca Cola’s dividend growth It would be hard to find another company with a growth chart as smooth as this one!.

L'auteur, Joshua Kennon, a décortiqué les données relatives au titre de la société CocaCola Il a utilisé l'année 1962 en tant que point de départ, pour le compte de deux individus. CocaCola holds almost $176 billion in liquidity, and the company remains profitable This should allow it to cover the annual dividend expense of just over $7 billion Walking away from a 58. CocaCola DRIP Plan Prospectus CocaCola DRIP Plan Summary Fees/Investment Options Consecutive Years of Higher Dividends 52 Purchase Fees $3 $003/share (cash purchase) $2 $003/share (automatic investment) Dividend Reinvestment Fee.

35% Yield Coca Cola (KO) Declares $041 Quarterly Dividend;. Qualifying the company as Dividend King, Dividend Aristocrat, and Dividend Champion KO has a wide moat based on a powerful brand, barriers to entry, and cost advantages Current Dividend Annualized $164. Jan 7, 21 625AM EST CocaCola (NYSE KO) pays investors a reliable dividend that yields about 3% per year That's better than the 16% yield you can expect from the average S&P 500 stock.

CocaCola (NYSE KO) is paying a forward dividend yield of 278%, which is 1 percentage points above the United States 10year Treasury yield at the time of this writing. It has a payout ratio of 16% of net income The company’s dividend payments have grown at a CAGR of 76% over the past five years MCD Net Income has increased 93% yearoveryear to $176 billion in the third quarter ended September 30,. CocaCola Company (KO) will begin trading exdividend on September 14, A cash dividend payment of $041 per share is scheduled to be paid on October 01, Shareholders who purchased KO.

The Complete Dividend History of The CocaCola Company(KO) Back to Dividend History US Stocks. Dividend Summary The next CocaCola Co dividend is expected to go ex in 2 months and to be paid in 2 months The previous CocaCola Co dividend was 41c and it went ex 2 months ago and it was paid 1 month ago There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 19. The CocaCola pays an annual dividend of $164 per share, with a dividend yield of 337% KO's most recent quarterly dividend payment was made to shareholders of record on Tuesday, December 15 The company has grown its dividend for the last 57 consecutive years and is increasing its dividend by an average of 348% each year.

33% Yield Coca Cola (KO) Declares $041 Quarterly Dividend;. Coca Cola (KO) Declares $041 Quarterly Dividend;. The CocaCola Company Dividend Analysis Dividend Yield We will use the current price of $4909 (12/07) KO’s current dividend is $156 per year This Payout Ratio Typically, we use a 60% payout ratio threshold for stocks to pass our screener At $8 estimated Dividend Growth Rate And.

Dividend History for CocaCola Co (KO) Ticker Expand Research on KO Price 5484 Annualized Dividend $164 Dividend Yield 3% ExDiv Date. CocaCola pays investors a reliable dividend that yields about 3% per year That's better than the 16% yield you can expect from the average S&P 500 stockHowever, income investors can secure an. The CocaCola dividend has been paid continuously since 19 and increased for 58 consecutive years;.

About The CocaCola Company The CocaCola Company (NYSE KO) is a total beverage company, offering over 500 brands in more than 0 countries and territories In addition to the company’s CocaCola brands, our portfolio includes some of the world’s most valuable beverage brands, such as AdeS plantbased beverages, Ayataka green tea, Costa. Dividende KO acordate in perioada 11 05, data exdividend, data AGA si detalii legate de distribuirea dividendelor KO. Historical dividend payout and yield for CocaCola (KO) since 1964 The current TTM dividend payout for CocaCola (KO) as of December 31, is $164 The current dividend yield for CocaCola as of December 31, is 303% The CocaCola Company is the world's largest total beverage company.

For Coca Cola Co, its beta is lower than 7864% of dividend issuing stocks we observed. CocaCola is known as a Dividend Aristocrat. CocaCola is a Dividend Aristocrat, a group of 66 stocks in the S&P 500 with at least 25 consecutive years of annual dividend increases CocaCola will have little trouble maintaining its dividend growth in the years ahead, even if the US economy goes into a deep recession Business Overview and Recent Events CocaCola is the world’s largest beverage company, as it owns or licenses more than 500 unique nonalcoholic brands.

You already know KO has paid 41 dividend payouts since Nov 29, 1999 Now let us see the data for BAC and KO Bank of America Corporation (BAC) has paid 86 dividends since Dec 01, 1999 and CocaCola Company (The) (KO) has paid 41 dividends since Nov 29, 1999. The CocaCola (NYSE KO) dividend history is long and reliable The stock has made a great addition to many income portfolios Let’s check out the business, dividend history and payout safety going forward Business Overview and Highlights CocaCola is a $196 billion business The company is based out of Atlanta, Georgia and employs 61,800. KO pays $164 in dividends annually, yielding 31% at its current price It has a payout ratio of 865% of the net income The company’s dividend payments have grown at a CAGR of 56% over the past five years KO’s NonGAAP operating margin has increased 230 basis points yearoveryear to 304% in the third quarter ended September 30,.

CocaCola Company (KO) will begin trading exdividend on September 14, A cash dividend payment of $041 per share is scheduled to be paid on October 01, Shareholders who purchased KO. CocaCola is a Zacks Rank #3 (Hold) at the moment that still faces uncertainty given the big impact that the virus continues to have on stadiums, concerts, restaurants, and more. Dividende The CocaCola Company avec prévision des dividendes et des rendements , 21 Historique des dates de détachement et versement.

You can apply the same method to get the average dividends per share growth rate During the past 13 years, the highest 3Year average Dividends Per Share Growth Rate of CocaCola Co was 1930% per year The lowest was 460% per year And the median was 930% per year. The CocaCola Company (KO) manufactures, distributes, and markets nonalcoholic beverages worldwide This dividend king has paid uninterrupted dividends on its common stock since 13 and increased payments to common shareholders every for 55 years in a row Warren Buffett’s Berkshire Hathaway (BRKB) is the largest shareholder of the world’s largest beverage company. CocaCola is a Zacks Rank #3 (Hold) at the moment that still faces uncertainty given the big impact that the virus continues to have on stadiums, concerts, restaurants, and more.

The growing CocaCola dividend is one of the key factors fueling CocaCola’s stock market gains Since 19, the CocaCola dividend has increased — the quarterly dividend — from just under $004 on a splitadjusted basis To $040 per share That’s a 967% increase in the dividend!. CocaCola Consolidated, Inc (NASDAQCOKE) announced a quarterly dividend on Friday, January 8th, Zacks reports Shareholders of record on Friday, January 22nd will be paid a dividend of 025 per. Official Company Update on CORONAVIRUS click here Dividends Stock Info Stock Info Overview;.

CocaCola paid investors $0 per share a decade ago Over the last 10 years, the dividend has climbed to $160 That’s an % increase, and you can see the annual changes below The compound annual growth is 62% over 10 years but over the last year, the dividend climbed 26%. The CocaCola dividend annual raise is one of the few traditions in corporate America that happens with generational predictable regularity Every February since 1963, the CocaCola dividend has been raised And even before that, the CocaCola dividend had been at least maintained every year dating back to the 19 IPO. The CocaCola Company "Dividends" Accessed July 25, Macrotrends "CocaCola 56 Year Dividend History" Accessed July 25, Mitre Media "Best Beverages Soft Drinks Dividend Stocks.

CocaCola schüttet vier Mal im Jahr eine Dividende aus Dies ist immer im April, Juli, Oktober und Dezember der Fall Die nun ausgeschüttete Dividende betrug wie bereits in den letzten 3 Quartalen $0,41 je Aktie Dies entspricht einer Steigerung von 2,5% im Vergleich zum Vorjahr PErsönlich Ich habe 100 Anteile von CocaCola in meinem Depot. Even with a higher payout ratio than 10 years ago, CocaCola is in a good position With a long history of payouts, it’s unlikely to cut the dividend anytime soon CocaCola is one of top consumer staples stocks CocaCola’s dividend history is solid, along with the other consumer staples stocks And that’s just the tip of the iceberg. Historical dividend payout and yield for CocaCola (KO) since 1964 The current TTM dividend payout for CocaCola (KO) as of January 15, 21 is $164 The current dividend yield for CocaCola as of January 15, 21 is 337%.

The superficially exciting number will be when CocaCola’s quarterly dividend hits or crosses the $ mark sometime in the early s That will mark the moment when Berkshire Hathaway shareholders collect as much in a given year from their dividends as Buffett initially made to fund the investment. A stock’s Dividend Uptrend rating is dependent on the company’s pricetoearnings (P/E) ratio to evaluate whether or not a stock’s dividend is likely to trend upward If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock’s dividend to increase. CocaCola Consolidated gibt Dividende für das vierte Quartal bekannt 1707 CocaCola gibt seit 100 Jahren eine Dividende bekannt 2304 CocaCola schüttet seit 100 Jahren eine Dividende.

In terms of opportunity, Coca Cola Co's estimated return of 4514% surpasses about 7948% of dividend issuers we applied the dividend discount model to Beta tells us how volatile a stock's price is relative to the broader equity index;. CocaCola Co Dividends per Share Calculation 1 Dividend Payout Ratio measures the percentage of the company's earnings paid out as dividends CocaCola Co's 2 Dividend Yield % measures how much a company pays out in dividends each year relative to its share price.

Warum Coca Cola Ein Weiteres Halbes Jahrhundert Lang Ein Dividenden Aristokrat Bleiben Konnte The Motley Fool Deutschland

Will Coca Cola Raise Its Dividend In The Motley Fool

2 Aktien Die Mehr Dividende Zahlen Als Coca Cola Doch Darum Steht Trotzdem Der Us Aristokrat Auf Meiner Watchlist The Motley Fool Deutschland

Coca Cola Dividende のギャラリー

Q Tbn And9gcs6b4ynr4 Gkgd3ttc4zemg1yepvdjd5jyj42embu8 Usqp Cau

Pin Auf Dividenden

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

Aktien Sparplan Aktien Sparplan Geldmanagement

Doppelte Coca Cola Aktie Versus Anleihe

The Coca Cola Company Endlich Im Aktien Depot Sparkojote Youtube

Ko New York Stock Quote Coca Cola Co The Bloomberg Markets

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

Passives Einkommen Mit Coca Cola Wie Das

Wie Sicher Ist Die Dividende Von Coca Cola Finanzen100

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

Tout Savoir Sur Le Dividende Coca Cola Revenus Et Dividendes

Coca Cola Die Vergessene Aktie Borse Am Sonntag

So Jagen Anleger Richtig Nach Dividenden Manager Magazin

&hash=b3156d25a34032e7d7ce87011ad4f99ffc2ba4c9e7551edfcdfd4de8b71a7ccd)

3syfgi1tq Xfjm

Dividende Mit Diesen Zehn Aktien Konnen Sie Nur Gewinnen Welt

Dividende Von Coca Cola Im Oktober Jung In Rente

Wie Sicher Ist Die Dividende Von Coca Cola Aktiencheck De

Q Tbn And9gcqouav6nq Z8 Olp7jcpavf 69g2esyzejvuedintjyfni5ofxr Usqp Cau

Coca Cola Hauptversammlung 21 Wie Viel Dividende Gibt S

Coca Cola Aktie Kaufen Oder Verkaufen 21 6 Analyse Infos

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

Coca Cola Lisas Aktien Und Finanzen

Qui Sont Les Meilleurs Payeurs De Dividendes Objectif Rente

Dividende Von Coca Cola Kehfamilytrust

Coca Cola Aktienanalyse Eine Erfrischende Aktie 100 Jahre Dividende

Kassenzettel Coca Cola Dividende Juli Schwarzgeld

Dividendenzahlung Von Coca Cola

Nachkauf Von Coca Cola So Reinvestiert Ich Die Dividende Sparkojote

Coca Cola Aktienanalyse Eine Erfrischende Aktie 100 Jahre Dividende

Anlagen Vorsicht Dividende Ist Nicht Gleich Dividende Cash

Wird Coca Cola 18 Die Dividende Erhohen Finanzen100

Wird Coca Cola Seine Dividende 19 Erhohen Von The Motley Fool

Die Weihnachtsaktie Zahlt Dividende Eine Andere Erhoht Ihre Deutlich Divantis

Coca Cola Dividend Claim 64 Dividend Just Like Warren Buffett

Wird Coca Cola 18 Die Dividende Erhohen Finanzen100

Coca Cola Extrem Mehr Dividende Als In Der Finanzkrise

Dividende Von Coca Cola Im Oktober Jung In Rente

Ausschuttungen 63 Us Dividenden Aristokraten Das Nonplusultra Der Qualitatsaktien Cash

2 Cola Dividenden Und 1 Kursenttauscher

Dividende Von Coca Cola Kehfamilytrust

3 6 Dividende Von Coca Cola Soll Man Kaufen Youtube

Dividende Von Coca Cola Kehfamilytrust

Ist Die Coca Cola Aktie Ein Guter Kauf Onvista

Will Coca Cola Raise Its Dividend In The Motley Fool

If You D Invested 1 000 In Coca Cola S Ipo This Is How Much Money You D Have Now The Motley Fool

Coca Cola Company Dividende Story Youtube

Dividendenadel Us Aristokraten Kontinuitat Allein Ist Zu Wenig

Weniger Als Erwartet Coca Cola Erhoht Dividende Und Kundigt Neues Aktienruckkaufprogramm An Aktie Im Plus

How Slp Dividends Can Tokenize Anything Including The Stock Market Emerging Markets Bitcoin News

Aristocrates Du Dividende Des Actions A Long Terme Pour Investir En Bourse

Coca Cola Aktienanalyse Getrunken Wird Immer Cashflow ebuch

Coca Cola Analyse En Bourse Du Leader Du Soda Au Cola

Nachkauf Von Coca Cola So Reinvestiert Ich Die Dividende Sparkojote

Coca Cola Eine Der Lieblingsaktien Von Warren Buffett

Tout Savoir Sur Le Dividende Coca Cola Revenus Et Dividendes

Coca Cola Stock Analysis Ko Dividend Review Dividends Diversify

Dividenden Eine Sichere Einnahmequelle

Dividend Aristocrats In Focus Part 57 Coca Cola Sure Dividend

Coca Cola Company Aktie Analyse Alleaktien

Wo Wird Die Coca Cola Aktie In 10 Jahren Stehen The Motley Fool Deutschland

Coca Cola Co Ko Dividends

Coca Cola Company Schuttet Unveranderte Dividende Von 0 41 Aus

3 Dividend Stocks That Pay You Better Than Coca Cola Does The Motley Fool

Comment Acheter Des Actions Coca Cola En Bourse

Auf Die Coca Cola Dividende Ist Verlass

Coca Cola Schuttet 1 248 Us Dollar Dividende An Warren Buffett Aus Jede Minute The Motley Fool Deutschland

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

Der Oktober Startet Mit Bewahrter Dividende Von Coca Cola

3 Aktien Im Blick Unzyklisch Lebensmittel Branche Burggraben Finanz Kroko

Pepsi And Chill Pepsi Peach Drinks Chill Drinks

Coca Cola Aktienanalyse Dividende Fairer Preis Youtube

Coca Cola Analyse En Bourse Du Leader Du Soda Au Cola

Coca Cola Stock Analysis Ko Dividend Review Dividends Diversify

Coca Cola Bani Din Dividende Portofoliu Youtube

5 Dividenden Investitionstipps Mit Denen Man Tausende Verdienen Kann Onvista

Q Tbn And9gcrwyqlfxp Dmheqhkbeq0g68b3e1oawfxcptxjeyup2co5uhvld Usqp Cau

Q Tbn And9gcrbpbhctiud76dbjawr Xu07hgcpdwn4xiblp Hfmkt6ipornxs Usqp Cau

Coca Cola Die Dividende Steigt Und Steigt Anlegerplus

Ko Dividend Date History For Coca Cola Co Dividend Com

Coca Cola Wird Der Dividendentitel Noch Gunstiger Onvista

Coca Cola Aktienanalyse Deutsch Kaufen Oder Nicht Susse Dividende Youtube

Tout Savoir Sur Le Dividende Coca Cola Revenus Et Dividendes

Dividendenstrategie 5 6 Grunde Fur Eine Dividendenstrategie Pro Argumente Tradermagazin

Coca Cola Rente Mit Dividende

Hohe Dividende Das Mussen Anleger Beachten Cash News

Coca Cola Und Pepsico Aktie Unterschied Bei Dividende

Auf Die Coca Cola Dividende Ist Verlass

Word Cloud Summary Of Coca Cola A Value Stock Article Stock Photo Alamy

Coca Cola Schockt Mit Heftigem Absatzeinbruch Ist Die Konigliche Dividende In Gefahr

Aktienanalyse Coca Cola Hellenic Bottling Company Simple Value Investing

Coca Cola Mit Revolution Comeback Fur Die Aktie Der Aktionar

Coca Cola Stock Dividend What Investors Need To Know Now Sure Dividend

Coca Cola Stock Dividend What Investors Need To Know Now Sure Dividend

Coca Cola Aktie Mit 3 5 Dividende Den Renditedurst Gestillt

:max_bytes(150000):strip_icc()/coca-cola-quarterly-earnings-beat-expectations-1163791740-29e84481a1da4337af2a38c9dc1532b7.jpg)

Coke And Pepsi Offer Sweet Dividends

Meine Sparplane Jeden Monat Dividende Finanz Kroko

Coca Cola Dividend Claim 64 Dividend Just Like Warren Buffett

Coca Cola Impact Soft Du Coronavirus

Coca Cola Analyse En Bourse Du Leader Du Soda Au Cola

Kassenzettel Coca Cola Dividende Juli Schwarzgeld