Ma Boutique Frankfurt

Investment banking/M&A currently 1325 jobsThe latest job was posted on 19 Jan 21 Investment Banking / M & A Many investment banking jobs listed on efinancialcareerscom focus on M&A mergers and acquisitions This area of the finance world deals with businesses who merge to become one, or businesses who buy another company, either wholly or in part.

Ma boutique frankfurt. Berkery, Noyes & Co – A boutique investment banking firm providing debt and equity financing, M&A advisory and financial consulting services to companies in the middlemarket BG Capital – With more than years of experience, the firm provides mergers and acquisition advisory services for small and midcap clients. Parklane Capital is an international M&A and corporate finance boutique with focus on growth companies in the technology, internet and media sector. Our focus is on national and crossborder transactions in Europe, principally involving the Germanspeaking region Germany, Switzerland and Austria and the UK Our officies are in London Frankfurt and Hamburg.

Berkery, Noyes & Co – A boutique investment banking firm providing debt and equity financing, M&A advisory and financial consulting services to companies in the middlemarket BG Capital – With more than years of experience, the firm provides mergers and acquisition advisory services for small and midcap clients. At UpSlide we help M&A firms work better and faster, we directly work hand in hand with them and are greatly impressed by the impact their actions have on the global economy 15 was a brilliant year for Global M&A, which was at an alltime high with $428 trillion worth of deals 16 is being seen as a record year for broken deals, as the US market is cracking down on deals that aid tax. The wellappointed U Executive Panorama Room (Approx 35m 2) is suitable for a couple with a child and features a balcony overlooking the beautiful Sea of Galilee and the hotel's poolExecutive Panorama Rooms are equipped with espresso machine, minibar, Interactive Television (IPTV), airconditioning, bathroom with a shower, L'occitane Products, a digital scale, hair dryer, and a safe deposit box.

Richard advises clients on sellside mergers and acquisitions (M&A) and is responsible for the industrial sector in Germany He has nearly 30 years of advisory experience within the German corporate finance advisory market and has assisted clients with disposals, acquisitions, public takeovers, initial public offerings, secondary placements, privatizations, private placements and debt financing. & Other Stories in Frankfurt am Main, reviews by real people Yelp is a fun and easy way to find, recommend and talk about what’s great and not so great in Frankfurt am Main and beyond. Contact Level 21, Saigon Centre Tower 2 67 Le Loi, Ben Nghe Ward, District 1 Ho Chi Minh City, Vietnam T 84 28 7302 8169.

Birger Nahs is Founder and Managing Partner of MONTIS Corporate Finance GmbH, founded in 18 and located in Frankfurt/Main, Germany He has been active in the M&A advisory business since 01 and was involved in more than 40 successfully completed sellside, buyside and financing transactions His focus has been on the technology sector. Trustberg LLP is a boutique law firm specializing in corporate law, mergers & acquisitions (M&A) and venture capital with offices in Munich, Berlin, Frankfurt and London trustberg LLP advises listed stock corporations, but also small and mediumsized enterprises as well as creative and technology industries. Frankfurt am Main Finding us The nearest UBahn is Alte Oper We’re also a short walk from WillyBrandtPlatz Paris Telephone 33 (0) 1 87 65 30 00 Email france@dartmouthpartnerscom Address Dartmouth Partners WeWork 33 rue la Fayette Paris Finding us The nearest tube station is Le Peletier.

As an independent, privately owned firm we maintain offices and representations in Frankfurt, Berlin, Munich, Zurich, Hong Kong and New York as well as strong alliances in the UK, France and India To date, we have completed more than 400 transactions with a total deal/financing volume of approx EUR bn. Capital Raising for Growth Businesses We offer to manage for selective earlystage and proven technology companies a structured capitalraising process, M&A advisory services, thus leveraging of a diverse and larger investor base, madeup of smart investors such as family investors, corporate investors, different VC investors operating in both developed and emerging markets. Global dealmakers North American M&A market update Article Food and beverage M&A update Q1 Article Legislation changes to the Energy Investment Tax Credit (ITC) may increase your project’s eligibility Article The value of asset allocation and portfolio diversification in tumultuous times.

KBR Groupis a boutiquesize international advisory firm, with one main product offering independent, discreet and high quality advice, including transformational M&A, larger IPOs and financing alternatives through innovative structures. Analyst – M&A / Corporate Finance – Click here for more information – Frankfurt Intern – M&A / Corporate Finance – Click here for more information – Frankfurt Intern – M&A / Corporate Finance – Click here for more information – Paris Intern – M&A / Corporate Finance – Click here for more information – Milan. MarketLeading Strategic Insight from Globally Integrated Industry Groups We are part of the fabric of the industries we serve As a global M&A investment banking advisory firm, our services are delivered by a team of experienced senior bankers who have spent their careers developing deep professional relationships and building indepth knowledge of the companies, trends and insights relevant.

Working for an M&A boutique is the new thingSenior and junior investment bankers have been making the move away from the bulge bracket and into specialist shopsIf you're a graduate trying to get. Contact Level 21, Saigon Centre Tower 2 67 Le Loi, Ben Nghe Ward, District 1 Ho Chi Minh City, Vietnam T 84 28 7302 8169. MATTERLING is an independent M&A boutique specialized on transactions in the food and drink sector in Europe.

M&A Boutique – Frankfurt – Analyst / Associate / VP A growing M&A / Corporate Finance boutique is looking to hire experienced corporate financiers at the Analyst, Associate and VP level to join its Frankfurt team Candidates must come from a leading IB or consultancy firm and have an excellent understanding of the German M&A market. Working for an M&A boutique is the new thingSenior and junior investment bankers have been making the move away from the bulge bracket and into specialist shopsIf you're a graduate trying to get. Junior banker dies at M&A boutique Firm denies working hours to blame by Sarah Butcher 30 July 18 Madrid, Milan, Amsterdam and Frankfurt and has been expanding globally Last year, it opened offices in Dallas and Munich This year it has been hiring in Sweden.

Wir laden Sie herzlich ein zur OnlineKonferenz „M&A hautnah in Fernost – ein Erfahrungsbericht„ am 29 Januar 21 um 1600 Uhr M&AProjekte werden im Westen meistens rein technisch und wirtschaftlich gesehen. Since its beginnings in 1995 as an advisory firm, Blackwood Capital Group has developed in over years into a fully fledged, FCA registered Corporate Finance and M&A advisory firm Today, we operate from our London headquarters as well as our office in Frankfurt, Germany. Altrius is a Frankfurt based M&A advisory boutique focused on mid to largescaled transactions and mainly German deal situations with crossborder and bilateral characteristics Our Senior Team would be pleased to share market insights and our deal flow with you and exchange thoughts.

M&A hotspot #2 Payments Payments processing has delivered rich rewards for sponsors As valuations and competition for assets intensifies, firms with established payments track records will be in a stronger position Roger Kiem, CoHead of FIG M&A, Partner, Frankfurt Investment Case. Definition An elite boutique investment bank (EB) is a nonfullservice firm that focuses on M&A Advisory or Restructuring, rather than capital markets, and that advises on the same types and sizes of deals as the bulge bracket banks – often with an industry or geographic specialty. Was Kandidaten mitbringen müssen, um bei einer Tier 1Boutique unterzukommen Unter M&ABoutiquen lässt sich viel verstehen, denn anders als im Banking braucht man für die Beratung bei Fusionen und Übernahmen keine besondere Lizenz Von daher reicht die Spanne von namenlosen Miniunternehmen mit kaum Mitarbeitern, bis hin zu weltumspannenden Häusern.

The leading M&A advisory firm for global midmarket transactions Clairfield is an international corporate finance firm that provides advisory services, mainly in crossborder mergers and acquisitions, to international corporations, familyowned businesses, and financial investors. Frankfurt offers 1012 week internships to undergraduate and postgraduate students yearround Interns will be given the opportunity to explore different groups through project assignments in all of our M&A industry groups and Restructuring Associate and Analystlevel mentors are provided to ensure a fulfilling internship experience. Picard Angst is an independent Swiss financial services provider We offer institutional investors investment funds, asset management on a mandate basis, and structured products since 03.

He then founded an M&A boutique, Finfortec, where he spent several years gaining experience in later stage and buyout deals Before becoming the Managing Director at Redstone he worked for Klingel Group, building their inhouse corporate Venture Capital arm which he ran for three years. We are an independent advisory boutique specializing in Mergers & Acquisitions as well as developing corporate growth strategies BUYSIDE M&A Individual client support throughout the mandate in order to achieve strategic and financial goals through intelligent and creative solutions while focusing on the client’s interests and expectations. Definition An elite boutique investment bank (EB) is a nonfullservice firm that focuses on M&A Advisory or Restructuring, rather than capital markets, and that advises on the same types and sizes of deals as the bulge bracket banks – often with an industry or geographic specialty.

Markus gained its comprehensive experiences from his former engagements with leading international law firms in Frankfurt am Main as well as from his service as a partner of a wellknown German M&A/PE boutique German PE funds, family offices as well as corporates of every scale are highly satisfied clients of Markus. M&A and Strategic Advisory Capital Raising Restructuring Excellence is our standard A dedicated team of highly experienced professionals delivering top quality services TEAM AND INTERNATIONAL NETWORK Dedicated team of highly experienced professionals. Evercore Inc (formerly known as Evercore Partners) is a global boutique investment bank with 1,900 employees and over $2 trillion in announced M&A transactions The company has offices worldwide including locations in Toronto (Canada), Mexico City, Aberdeen and London (UK), Madrid (Spain), Hong Kong, Beijing (China), Dubai (UAE), Singapore, Tokyo (Japan) and Frankfurt am Main (Germany).

The Leonardo Royal Hotel Frankfurt is only 5 min from downtown and the main station and less than 15 min to the Congress Center and Frankfurt Airport and can be easily reached via the motorways A3 and A5 A bus stop for Frankfurt’s main sights is located right at the hotel’s doorstep The 25storey Frankfurt hotel was built on the highest point of Frankfurt. Evercore is the premier global independent investment banking advisory firm dedicated to helping clients achieve superior results through trusted independent and innovative advice. Junior banker dies at M&A boutique Firm denies working hours to blame Zurich, Madrid, Milan, Amsterdam and Frankfurt and has been expanding globally Last year, it opened offices in Dallas.

Frankfurt, November ACXIT Capital Partners acted as the exclusive M&A and financial advisor to the shareholders on the trade sale of Römergarten Residenzen GmbH and Römergarten SeniorenResidenzen BaWü GmbH, highquality operators of elderly care facilities, to the global infrastructure investment manager I Squared Capital. Our Asset Management team in Frankfurt has a strong track record, with longterm relationships with institutional as well as fund distributors We offer an innovative and complementary range of products, from conviction driven management funds to alternative investments and smart beta solutions. Goetzpartners is an independent advisory firm for all key issues of entrepreneurial activity strategy, M&A and transformation This unique approach makes clients measurably more successful The combination of corporate finance and management consulting creates sustainable added value when determining valid courses of action, reaching decisions and implementing them.

Our Asset Management team in Frankfurt has a strong track record, with longterm relationships with institutional as well as fund distributors We offer an innovative and complementary range of products, from conviction driven management funds to alternative investments and smart beta solutions. Markus gained its comprehensive experiences from his former engagements with leading international law firms in Frankfurt am Main as well as from his service as a partner of a wellknown German M&A/PE boutique German PE funds, family offices as well as corporates of every scale are highly satisfied clients of Markus. A There are quite a few private equity firms here, and largecap funds such as Apollo regularly recruit Frankfurtbased bankers for their German or London offices Most of the funds in Germany are based in Munich or Frankfurt, but some are also in Düsseldorf (eg, Blackstone) and Hamburg (eg, BC Partners).

Parklane Capital is an international M&A and corporate finance boutique with focus on growth companies in the technology, internet and media sector. We are an independent advisory boutique specializing in Mergers & Acquisitions as well as developing corporate growth strategies BUYSIDE M&A Individual client support throughout the mandate in order to achieve strategic and financial goals through intelligent and creative solutions while focusing on the client’s interests and expectations. Saxenhammer & Co is a leading boutique investment bank in Continental Europe The firm’s strong track record is comprised of the execution of more than 230 successful transactions across all major industries Rathenauplatz 1A Frankfurt am Main Germany Phone 49 69 Email info@saxenhammercocom Munich.

Edelweiss is a Frankfurtbased boutique digitalising the M&A process – worldwide Our modern FinTech platform enhances the traditional M&A business with digital innovation We add value to the transaction process by providing full transparency at any step of the transaction. Lance is a network of independent advisors focusing on tax and legal services, capital solutions, restructuring and M&A, in Milano, London and Frankfurt. Boutique Agata, Frankfurt nad Menem 18K likes Zapraszamy na zakupy.

Goetzpartners, headquartered in Germany, ranks among the 10 bestperforming German advisory firms (Lünendonk®)Boasting a vast wealth of expertise in both crossborder mergers and acquisitions and management consulting, we are trusted by clients to provide excellent insights, transaction advisory services and value creation. Trustberg LLP is a boutique law firm specializing in corporate law, mergers & acquisitions (M&A) and venture capital with offices in Munich, Berlin, Frankfurt and London trustberg LLP advises listed stock corporations, but also small and mediumsized enterprises as well as creative and technology industries. Capital Raising for Growth Businesses We offer to manage for selective earlystage and proven technology companies a structured capitalraising process, M&A advisory services, thus leveraging of a diverse and larger investor base, madeup of smart investors such as family investors, corporate investors, different VC investors operating in both developed and emerging markets.

Evercore is the premier global independent investment banking advisory firm dedicated to helping clients achieve superior results through trusted independent and innovative advice. Boutique Banks Gain Foothold in German M&A Deals Perella Weinberg is the latest boutique bank to make headway in Germany A bronze bull and a bear stand in front of the stock market in Frankfurt. The leading M&A advisory firm for global midmarket transactions Clairfield is an international corporate finance firm that provides advisory services, mainly in crossborder mergers and acquisitions, to international corporations, familyowned businesses, and financial investors.

MATTERLING is an independent M&A boutique specialized on transactions in the food and drink sector in Europe. If bonuses rise, boutique bankers will partly have the newly booming M&A and restructuring markets to thank Evercore CEO R alph Schlosstein noted that global M&A volumes rose 38% yearonyear in the third quarter And Moelis & Co CEO, Ken Moelis, said yesterday that after M&A activity began its "resurgence" over the summer the pace of M&A. Frankfurt offers 1012 week internships to undergraduate and postgraduate students yearround Interns will be given the opportunity to explore different groups through project assignments in all of our M&A industry groups and Restructuring Associate and Analystlevel mentors are provided to ensure a fulfilling internship experience.

Lance is a network of independent advisors focusing on tax and legal services, capital solutions, restructuring and M&A, in Milano, London and Frankfurt. Edelweiss is a Frankfurtbased boutique digitalising the M&A process – worldwide Our modern FinTech platform enhances the traditional M&A business with digital innovation We add value to the transaction process by providing full transparency at any step of the transaction.

Consus Partner 51 Photos Financial Service Stephanstrasse 5 Frankfurt Germany

Oliver Marquardt Is The New Manager Of Our Office In Frankfurt Am Main Oaklins Germany Mid Market M A And Financial Advice Globally

Frankfurt Institute For Private Equity And M A Fipema Frankfurt School

Ma Boutique Frankfurt のギャラリー

Investment Banking Analyst Salary Updated Wall Street Prep

Bnp Paribas Lost A Top M A Banker In Frankfurt Efinancialcareers

Andrew Taylor Senior Vp M A The Avanti Group Attends Finance And E

Investment Banking Recruiting In Europe

Altrius M A Advisory

M A Boutique Frankfurt M A Deals M A Boutique Berater Frankfurt

Jim7kg3 U43aam

Freitag Co Investment Banking Boutique

Clairfield Ubernimmt M A Boutique Pericap Finance Magazin

The Euro Asia M A Boutique Pdf Free Download

M A Senior Analyst M W D S I Team Uz 38d

Oliver Marquardt Is The New Manager Of Our Office In Frankfurt Am Main Oaklins Germany Mid Market M A And Financial Advice Globally

Www2 Staffingindustry Com Content Download M A Fundersadvisorsdirectory Free 0902 Pdf

About Us Caper

Top 10 Middle Market Investment Banks List Wallstreetmojo

Elite Boutique Investment Banks Overview Career Opportunities

July Round Up Moves M A Fund Launches And Closures

Kloepfel Corporate Finance Leads Via Optronics To The Us Stock Exchange Kloepfel Corporate Finance

Altrius M A Advisory

Alexandra Heidemann M A Analyst Taurus Advisory Linkedin

Home Ec Mergers Acquisitions Ec M A

M A Shirt Design And Accessories Facebook

Sainoo

Cdi Global Advises Groupe Anjac In Key Acquisition News Insights Cdi Global

Transactions General Archives Consus Partner

Global Arbitration Review Deutsche Bank Seeks Injunction Over Failed Mexican M Amp A

Melchersraffel Ltd M A And Strategy Consulting In Europe Asia

Cv And Career Dl Lead

Altrius M A Advisory

Acxit Instagram Posts Photos And Videos Picuki Com

Artemis Group Corporate Finance Advisors

50 Most Powerful M A Firms In The World

Frankfurt Institute For Private Equity And M A Fipema Frankfurt School

Ludwig Co Awarded As Boutique Advisory Firm Of The Year 18 Ludwig Co Gmbh

Freitag Co Investment Banking Boutique

50 Most Powerful M A Firms In The World

Euromoney Old Fashioned Evercore Makes It To The Major Leagues

Boutique Banks Gain Foothold In German M A Deals Wsj

M A Outlook 19 Boutique M A Mergers And Acquisition Specialist Justin Levine

Mergers Acquisitions Sell Side Handbook

M A Berater Finance Magazin

Mercer Acquires Frankfurt Based Promerit Adds 100 Hr Consultants

Acxit Capital Partners Awarded As Best Boutique Merchant Bank 16 Germany Acxit Capital Partners

Strategic Boutique M A Firms Are Taking On The Big Name Investment Banks Corniche Growth Advisors

Consus Partner 51 Photos Financial Service Stephanstrasse 5 Frankfurt Germany

1.jpg)

Kwm Adds Boutique To German Operation The Global Legal Post

As Morgan Stanley Vtb And Citi Make Brexit Threats Boutiques Are Building In Frankfurt Efinancialcareers

Consulting Specifying Engineer Weekly Merger Acquisition Deal Update November 6

Metals News A Small Wall Street Firm Is Crushing It In Dealmaking Evr

Acxit Capital Partners

Delphi Advisors Frankfurt Am Main Germany

50 Most Powerful M A Firms In The World

Cross Border M A And Private Equity Investment Conference

M A Outlook 19 Boutique M A Mergers And Acquisition Specialist Justin Levine

Zehn Managing Directors Bei Frankfurter M A Boutiquen Die Sie Kennen Sollten Efinancialcareers

H C F Hanse Corporate Finance Gmbh

Richard Floto Investment Banking Lincoln International

50 Most Powerful M A Firms In The World

Frankfurt Institute For Private Equity And M A Fipema Frankfurt School

Beyond The Deal Linkedin

Global Arbitration Review M Amp A Insurance Award Upheld In Frankfurt

Kbr Group

Artemis Group Corporate Finance Advisors

Junior Banker Dies At M A Boutique Firm Denies Working Hours To Blame Efinancialcareers

Acxit Capital Partners

Ludwig Co Awarded As Boutique Advisory Firm Of The Year Ludwig Co Gmbh

Altrius M A Advisory

Dla Piper S Former France Managing Partner Quits Firm To Launch M A Boutique Law Com International

How To Get Into Investment Banking In 21

Which Core Competences Of External M A Advisors I E Investment Banks Download Scientific Diagram

Rautenberg Amp Company Takes Over Bassewitz Amp Hochberg And Continues To Grow M Amp A Advisory Capabilities

M A In The Hosting Market Remains Strong

Cross Border M A And Private Equity Investment Conference

Was Sie Mitbringen Mussen Um Bei Einer M A Boutique Unterzukommen Efinancialcareers

Kloepfel Corporate Finance Your Partner For Mergers Acquisitions

Global Middle Market Investment Bank In Switzerland Lincoln

50 Most Powerful M A Firms In The World

M A Today Global Awards 14 By Kmh Media Group Issuu

Pdf Blue Ocean Strategy Online M A Platform Analysis

Martin Paev Chairman Of Sortis Group Spoke At The 4th Distressed Investments Forum In Frankfurt Germany Sortis Group

Jp Weber Expands Its Transaction Advisory And M A Team In Warsaw

Clairfield International New Partners Join Clairfield In Frankfurt

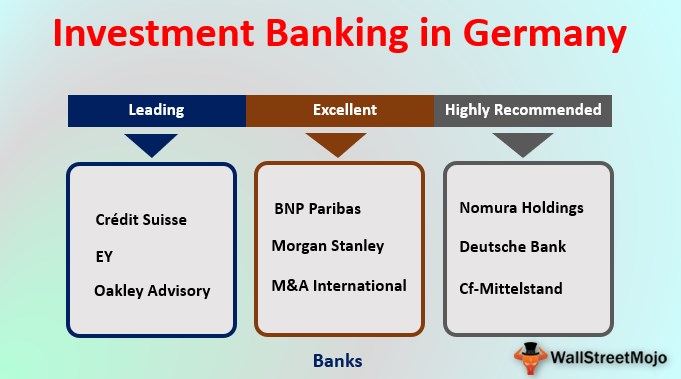

Investment Banking In Germany Top Banks Salaries Culture

Hiring At Jefferies In Paris Cuts At Houlihan Lokey In Frankfurt Efinancialcareers

Metals News A Tiny 3 Partner M A Boutique Is Beating Goldman Sachs In The Uk Dealmaking Table

Home Montis Corporate Finance

Deutsche Bank North America Ceo Jacques Brand To Leave For Pjt Partners Wsj

6 European Corporate M A Conference Convent

Richard Floto Investment Banking Lincoln International

Vision Ventures M A Boutique For Vision Tech Crunchbase Company Profile Funding

Www Pm Square Com

The Wall Street Journal Boutique Deal Makers Do Deals Of Their Own Alantra

Frankfurt Institute For Private Equity And M A Fipema Frankfurt School

Home Guez Partners

50 Most Powerful M A Firms In The World

U S Boutique Banks Woo French Bankers In Paris Advisory Push Sources Reuters

Investment Banking Germany S Number One Rainmakers